Many renters are asking should I buy or rent a home right now.

Many renters are asking should I buy or rent a home right now.

As renters are looking to renew leases or seek another place to live they are starting to realize that it may be cheaper to own a home than rent.

A recent study by Trulia shows that nationwide it is 36% cheaper to own. Realize that statistic can be radically different by region

Lets take a look at if you should buy or rent your next home from a financial standpoint. While there are other reasons to buy a home, the financial aspect is very compelling

Here in Tewksbury Massachusetts and the surrounding areas renters may find financially it makes more sense to own.

I did an analysis in the recent past of comparing renting to owning the same condo in the Tewksbury MA Real Estate market.

1830 Main Street in Tewksbury, had 3 condominium units that sold in the recent past for an average of $260,000 dollars. These units are nearly identical. There was also one identical unit that rented for $1850 a month.

A mortgage of 3% down with a self funded PMI (built into the monthly payment) with an interest rate of 4.75% taxes of $295 a month and a condo fee of $245 a month equals a payment of $1855 per month.

But Kevin, that’s higher…. no it is not.

While on the surface owning a home vs renting the same home may appear to be higher, there are other factors in play. You may find you have applicable tax deductions for owning a home. On top of potential tax deductions, you have the power of ownership over time.

The Power Is In Home Ownership over a Period of Time

Your principal payment while quite small in the beginning starts to add up every year. It is a forced savings plan. After year 5 you will have paid down your mortgage $21,000 and after 10 years $49,000. So if you go to sell what do you get back based on principal payments you have made.

Equity is built in your home by making steady principal payments against the balance! Yes there is a cost to sell, but say at year 10 you would still walk away with $34,000 (assuming closing costs and real estate commissions were $16,000).

And, don’t forget about the $29,400 you saved by owning over 10 years.

Alternately, what would you get back from renting? $1850.00 in security deposit. What would you rather have $1850 in your pocket or $63,400.

Ok, this is a bit simplistic. I have not calculated and general maintenance or rent increases, tax increase or condo fee increases into the equation. But still. you get my point.

Don’t Forget About Home Appreciation When Comparing Buying vs Renting

Now, we haven’t even added on home appreciation. Based on the National Association of REALTORS home appreciation over time is 3.7%. The Case Schiller Index says it is 3.4% but for out purposes I am going to say 2%.

Realize home appreciation fluctuate wildly over short periods of time. There is not a guarantee your home will appreciate in two years if you decide to sell. But it is safe to assume that after 10, 20 or even 30 years you will have experienced some significant appreciation.

In out above example, after 5 years the condo will have appreciated about $27,000 and in 10 years you would see about $56,000 in appreciation.

So would you rather buy vs rent your home?

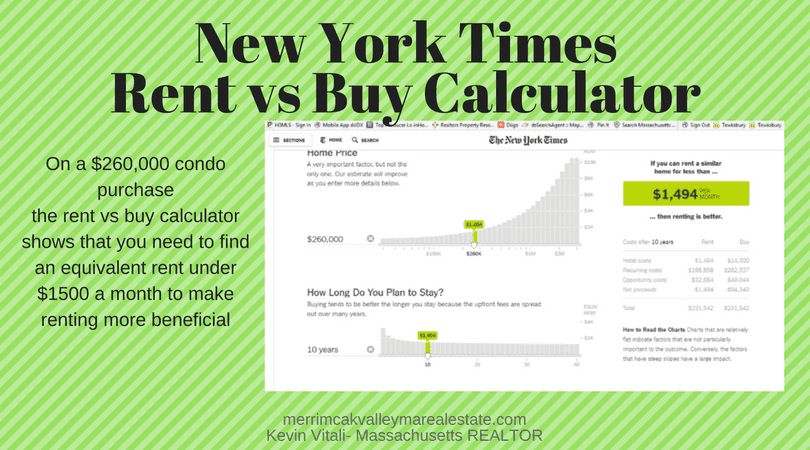

Comprehensive Rent vs Buy Calculator

The New York Times has a comprehensive rent vs buy calculator to see if buying a home vs renting a home is financially a better choice for you.

The NYT’s rent vs buy calculator takes into account home maintenance, inflation, interest rate on savings, rental increase, length of ownership, etc… to give you a more accurate picture of whether buying a home will be cheaper than renting a home.

If you take the above data with a purchase price of $260k and a rental price of $1850 a month, make a few assumptions the New York Times says that owning that same condo is better if the rent is over $1494 a month if you will be owning for a 10 year period and $1703 a month for a 5 year period. Personally, if you know you will be staying for less than 5 years you may want to rent. Buying a home for the short term can be risky business.

Reason being the real estate market can fluctuate short term and their is a cost to selling.

What could you do with a several hundred dollars a month?

Today’s real estate market only reinforces that buying is the the better option if you are asking if “Should I Buy or Rent?”

Other Reasons it is a Great Time to Buy

- Interest rates are still at historical lows. It is a great time to lock in that 30 year fixed mortgage.

- Plenty of low money down or even some no money down programs available.

- Owning a home provides stability.

- Its yours to do with what you want within the confines of the law!

Bottom Lineof Buy vs. Rent

If you feel personally this is now the right time to buy a home, buying a home may make a lot of sense for you financially.

Buying a home generally makes sense financially if you are buying for the long term. The long term being 10+ years. Think about your parents or grandparents. Many of them acquired some serious assets buy buying a house, making the payments and eventually paying it off.

What will your retirement look like if your home is paid off? Yes, you will still have taxes and insurance but no mortgage or interest payment which is the significant part of your payment. Of course taxes and insurance will rise, but so will taxes and insurance for your landlord as well and of course that will be passed on to you the renter!

Other Real Estate Resources:

- Kyle Hiscock- Should I Buy a Single Family of a Condo?

- Conor MacEvilly Your Home May Be Less of An Asset Than Your Think

- Joe Boylan Buying a Home with Bad Credit

If you are one of the many renters out there who would like to evaluate your ability to buy this year, let’s get together to discuss plan of action to get you into your first home! I can make buying your first home as painless as possible. Call me at 978-360-0422.