Get Your Free Annual Credit Report

Get your free annual credit report to maintain a great credit profile. Keeping a healthy credit profile will save you tens of thousand of dollars over a lifetime.... even more!

Get your free annual credit report to maintain a great credit profile. Keeping a healthy credit profile will save you tens of thousand of dollars over a lifetime.... even more!

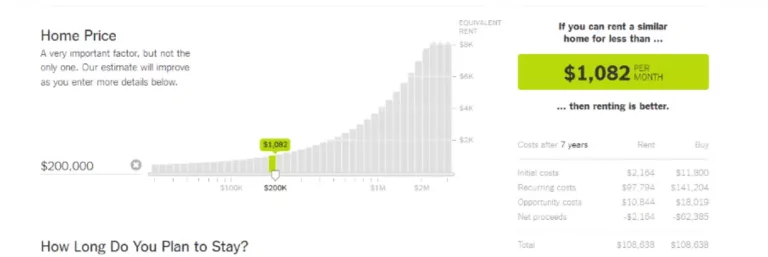

Many renters are asking should I buy or rent a home right now. As renters are looking to renew leases or seek another place to live they are starting to realize that it may be cheaper to own a home…

Recently I have been involved in a few real estate transaction where the buyer’s were able to secure 100% percent financing on no money down loan programs. While there are some caveats to securing a no money down loan, there…

Assessing Your Finances Once you think it may be a good idea to purchase a home, it is now time to assess your finances. The first thing to do is go to www.annualcreditreport.com . Do not use any other site…