You may have thought it is time to stop renting and buy your first home. The very next question most home buyers will ask is how much house can I afford to buy?

You may have thought it is time to stop renting and buy your first home. The very next question most home buyers will ask is how much house can I afford to buy?

At the end of the day, take the time to sit down and get a proper mortgage pre-approval letter from your lender.

There are many variables that go into determining how much house you can afford. This article will help you hone in on a ballpark figure of how much house you will qualify for to help you decide to take the next steps.

If you decide to move forward, one of your first tasks should be to get a pre-approval from a lender. The pre-approval process is very quick and requires a few documents like your paycheck stubs, bank statements, W2s and tax returns. Your mortgage lender can tell you how much house you can afford down to a few dollars and allows you to confidently move forward.

With this information, not only will you know the maximum amount a bank will lend to you on a home, but you will also be able to formulate a monthly budget you can live with.

Jump To A Section....

Understanding Home Affordability

When embarking on the homeownership journey as a Massachusetts first-time home buyer, one of the most pivotal questions you’ll ask yourself is, “How much house can I afford?” This query not only shapes your home search but also influences your financial stability and lifestyle for years. The affordability of a home is very individual and is based on several factors.

The Role of Mortgage Affordability in Home Buying

Mortgage affordability is the cornerstone of home buying. It’s essential to understand that the amount you can borrow depends largely on your financial health. Income, debt, credit score, and current home loan interest rates significantly determine your borrowing capacity. A home affordability calculator can give you a preliminary idea of what you can afford.

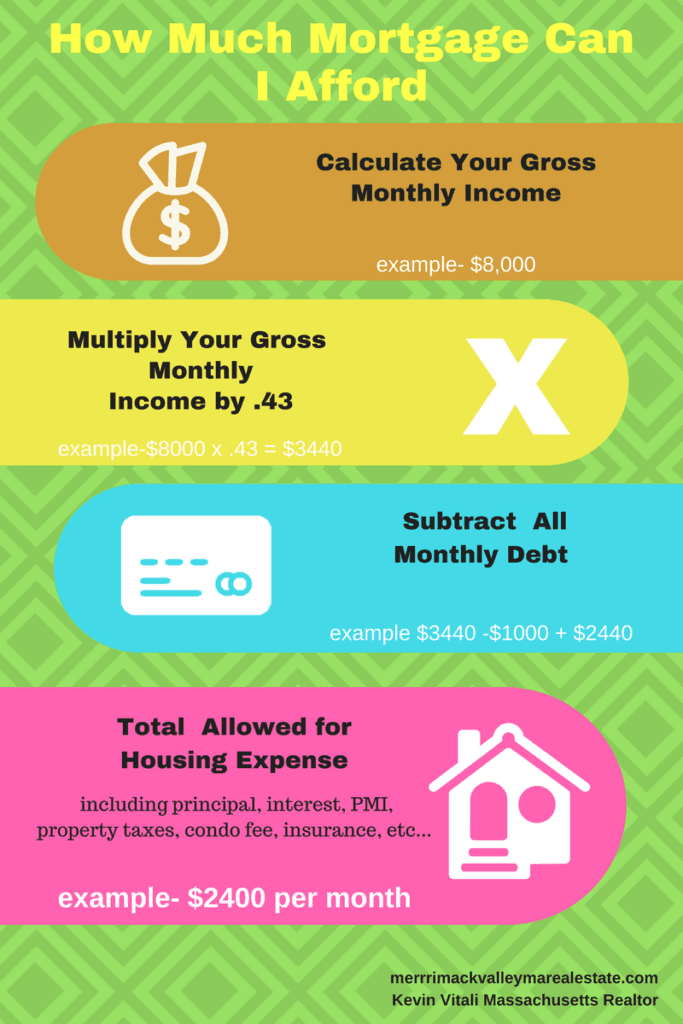

To calculate how much house you can afford, we will look at what the bank is looking for from you to give you an idea of how much of a mortgage payment you can qualify for from your lender. Lenders calculate these numbers monthly, so we will also for our purposes.

Housing Affordability Calculator

I have put together a calculator that will allow you to roughly calculate how much you can afford in a home and start to plan a budget for your new home.

Instructions For The Home Affordability Calculator

- Fill in your gross monthly income.

- Include your monthly consumer debt.

- From there, the calculator will show you a range of monthly house payments you might qualify for based on your debt-to-income ratio.

- You can then fill in the target purchase price of a house and your down payment.

- The calculator will estimate taxes and insurance. You can override the estimations if you have exact numbers.

- Find a current 30-year fixed rate online. And fill in the interest rate.

- If you are thinking of a condominium, there is a section to add an HOA fee.

- The calculator will return an estimated monthly payment, and you can then see where you fall regarding qualifying ratios. Many buyers fall in between the 38-41% range. More conservative borrowers try to maintain a lower ratio. More aggressive borrowers start increasing their debt-to-income ratio to the 45% to 50% range.

Understanding The Home Affordability Calculator

The home affordability calculator will help you understand what a bank might qualify you for. You can understand the range of how much house you can afford.

Gross Income

Your total monthly income before paying taxes and any other items subtracted from your paycheck is your gross income. If you are a W-2 salaried employee, this is relatively easy. Take your yearly salary and divide it by 12.

Once you start getting into overtime, bonuses, and self-employment, your gross income can get complicated, and you need to get that pre-approval from your lender.

Monthly Consumer Debt

Consumer debt is a steady and reoccurring payments you make every month to pay back any debt you have incurred. Car loans and student loans should be the same every month. But for credit cards, you only use the minimum monthly payment.

Child Support and Alimony

Use the miscellaneous category to include your monthly child support and/or alimony payment.

Debt-to-Income Ratio

This is the total housing expense and consumer debt ratio compared to your gross income. Traditionally, the debt-to-income ratio is broken down into your front-end expense (housing expense) and your back-end expense (total debt, including housing).

Your debt-to-income ratio is the big qualifier for getting a home loan. Thus, giving you an idea of how much house you can afford. Most banks will allow a maximum debt-to-income ratio between 38% to 43%, with some loan programs allowing as high as 45% to 50%.

Front End Ratio (Housing Expense)

This percentage of your gross income goes to housing expenses. These expenses comprise principal and interest payments on your home loan, private mortgage insurance, property taxes, property insurance, and the HOA fee.

For example, if your monthly gross income is $8000 and you are paying $2000 for your principal and interest payment, property tax, private mortgage insurance (if any) and property insurance your front-end ratio is 25%.

Back End Ratio (Total Debt)

Your back-end ratio is the percentage of your gross income that goes towards your housing expense and consumer debt. Consumer debt is any installment payment like student loans, credit card payments, auto loans, etc…

Take the numbers from above of an $8000 monthly income with $2000 for your housing now add $500 for a car payment, $250 for student loans and another $250 for credit cards… totaling $1000 of monthly consumer debt with total debt of $3000 (consumer and hosing combined) for a back end ratio of 37.5%.

What Do The Ratios Mean?

In years past, the government recommended a front-end ratio of no more than 28% for the front end and 36% for the back end. Over the years, the two have blended together, and the banks don’t pay attention to the front-end ratio. They are concerned with the total debt-to-income ratio or the back-end ratio.

Most loan programs will allow you to spend between 38% to 50% of your gross income on your back-end ratio. Conforming loans will allow up to 43%, FHA will allow up to 45% or sometimes up to 50%.

In the example above, with $8000 a month gross income and $1000 in consumer debt, the most the bank will allow you to spend a month on housing is roughly $2440 a month. This would translate into roughly a $345,000 home with a $17,250 down payment.

Now you know how much a bank will qualify you for in your monthly housing expense. can begin as you research communities and search for the home of your dreams!!

Get Pre-Approved Before Looking At Homes

Before you go off full tilt, could you take the time to get pre-approved? Any home affordability calculator will give you a rough number for pre-planning purposes and deciding if you want to pursue purchasing a home further.

An actual pre-approval is complicated and involves many variables, including your credit profile, loan program and more. Do yourself a favor and take the step to get pre-approved. This will allow you to prepare a budget and move forward with confidence.

Variables That Will Effect How Much House You Can Buy

So many variables will affect how much home you can afford. The strength of your credit profile, down payment, PMI and the amount of debt you carry all work together to create a mortgage payment you can afford when buying a house.

Every buyer wants to secure the best interest rate on their home mortgage, but all of these variables, plus other factors, can impact the interest rate available to you.

Consumer Debt

One variable in determining how much house I can afford is consumer debt. Consumer debt can vary from borrower to borrower.

Consumer debt is money you owe that you pay monthly. Examples of consumer debt are:

- Student Loans

- Credit Card Debt

- Car Loans

- Installment Loans

The minimum monthly loan payment for each line of consumer debt is subtracted from your gross income, lowering the income basis used to calculate the maximum mortgage the banks feel you can afford for a house.

Your FICO Score

Your credit score will play a part in how much you can afford. If you have poor to fair credit, banks will start to limit your maximum debt-to-income ratio and also prevent you from qualifying for the best loan programs available. It also affects the interest you will be offered. A higher credit score will mean a better interest rate, lessened qualifying criteria and more favorable loan programs.

Types of credit and utilization also play a large role in your credit score. For example, installment loans are viewed less favorably than other lines of credit. Also, carrying high balances compared to your available credit will hurt your credit score. Paying down consumer debt will allow you to buy a more expensive home.

Just about every 20 points in improvement in your credit score can have a favorable impact on your mortgage. While buying a home take any steps you can to improve your credit score. It will benefit you in the end.

Debt To Income Ratio

Your debt-to-income ratio is a crucial metric lenders use to assess your ability to manage monthly payments. Keeping this ratio within acceptable limits is vital for loan approval and long-term financial health.

You may also receive an improvement in your home loan interest rate if you have a lower debt-to-income ratio.

Loan Program

It is all about the loan program when shopping for a mortgage, especially if you are putting less money down. The loan programs will dictate what qualifying ratios are necessary, what the minimum required credit score is, what they offer for an interest rate and if Private Mortgage Insurance is required and at what rate.

Often, first-time home buyers putting 3-5% down will focus on interest rates. But, believe it or not, a loan program with a higher interest rate can cost less money per month. For example, some great loan programs don’t require PMI, thus lowering your monthly payment. Focus on loan programs and their benefits first and then compare monthly mortgage payments.

Taxes

Property taxes impact how much you can afford. When discussing your ratios, the bank includes taxes in your housing expenses.

Each home can have a wildly different tax base, even if sold for the same price. Bear in mind some towns have a higher mill rate than others. The more you pay in taxes the less you can spend on a house.

Insurance

Just like taxes the bank is going to consider your monthly tax payment. You will have your homeowners insurance, but think if you have to carry flood insurance on top of it.

The more you pay in insurance, the more it will cut into your buying power.

Increasing How Much House You Can Afford

With a bit of planning, there may be action items that help increase your buying power. What can increase your buying power?

Make More Money- It may seem obvious, but did you include bonuses or overtime in your income? Does your spouse maybe have a job that you could use the income to help qualify for a larger mortgage?

Increase Down Payment- By putting down more money, you can increase the price of the home you can afford. Beyond saving more money, consider gift funds, down payment assistance and using cash from your 401k.

Increase Credit Score- Increasing your credit score can give you a better interest rate, which will allow you to buy a more expensive home.

Pay Down Debt- Reducing your monthly consumer debt will allow you to spend more money on a monthly mortgage payment.

Consider An Adjustable Rate Mortgage- An adjustable-rate mortgage like a 7/1 ARM could lower your interest rate, allowing you to buy a more expensive home.

Home Affordability FAQs

What is the first step in determining how much house I can afford?

How does a mortgage pre-approval help in the home buying process?

Can I buy a house with a low down payment?

How does my credit score affect home affordability?

Should I consider additional costs beyond the mortgage in my budget??

What is the impact of real estate market trends on home affordability?

Other First Time Buyer Resources:

- Bill Gassett- First Time Home Buyer Tips

- Luke Skar- What is a Pre-approval vs Pre-qualification

- Lynn Pineda- Why Do I Need To Get a Mortgage Pre-approval

- Kevin Vitali- Avoid Last Minute Hurdles When Getting Your First Loan

Author Bio

Kevin Vitali is a Massachusetts REALTOR out of Haverhill MA that serves Essex County and Northern Middlesex County in Massachusetts. If you want to buy or sell a home, let me use my years of experience to get you the best possible outcome.

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com

Have questions about starting your home buyer journey? Don’t hesitate to reach out.

Real Estate Services in the following areas: Northeast Massachusetts, Merrimack Valley, North Shore and Metrowest. Including the following communities and the surrounding area- Amesbury, Andover, Billerica, Burlington, Chelmsford, Dracut, Groveland, Haverhill, Lowell, Melrose, Merrimac, Methuen, Middleton, North Andover, North Reading, Reading, Stoneham, Tewksbury, Tyngsborough, Wakefield, Wilmington, Westford