It doesn’t matter if you are trying to buy a foreclosed home with bad credit, you are a first-time homebuyer with bad credit or are moving up or down with bad credit, your sub-optimal credit score will be a stumbling block for you.

So, can you buy a house with bad credit?

The good news is you can buy a house with poor to fair credit. It may cost you a little bit more in interest over the life of the loan to have a less than perfect credit score, but your dream of owning a home can come true.

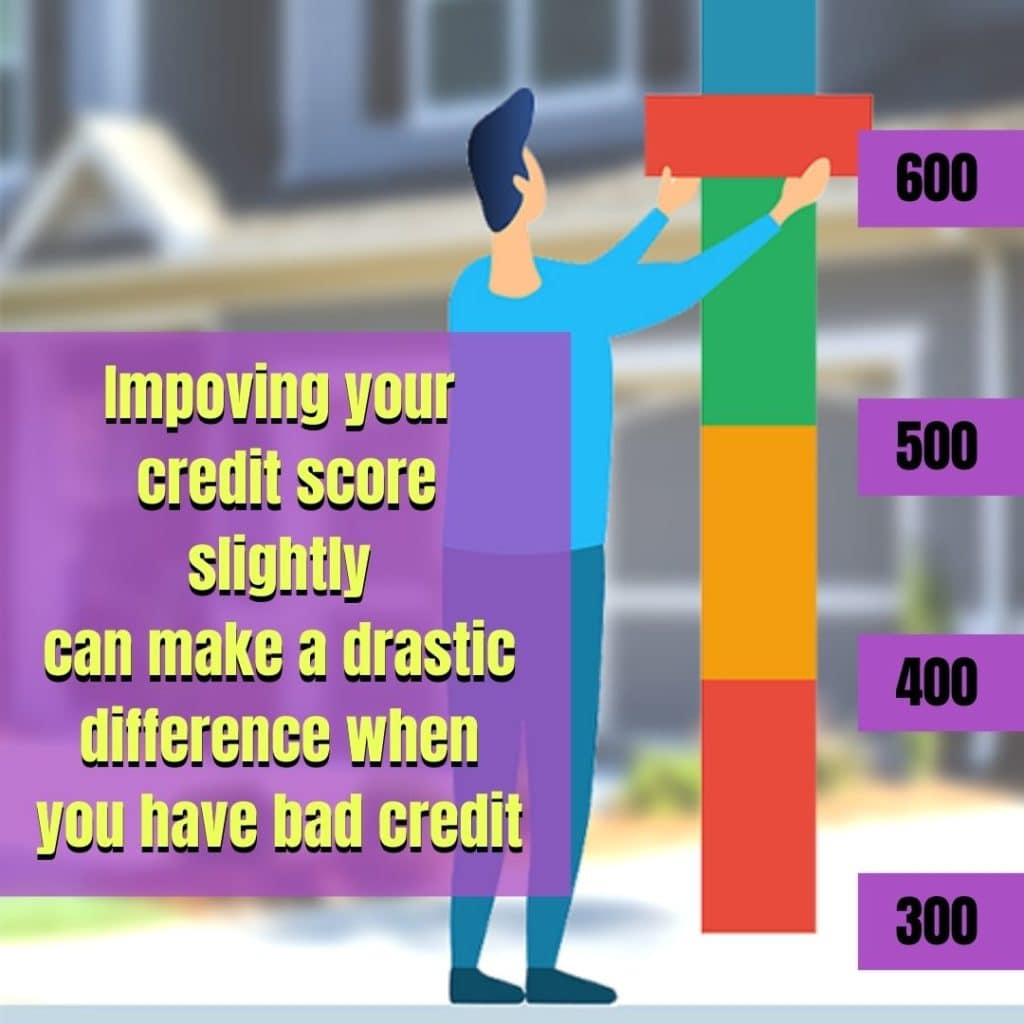

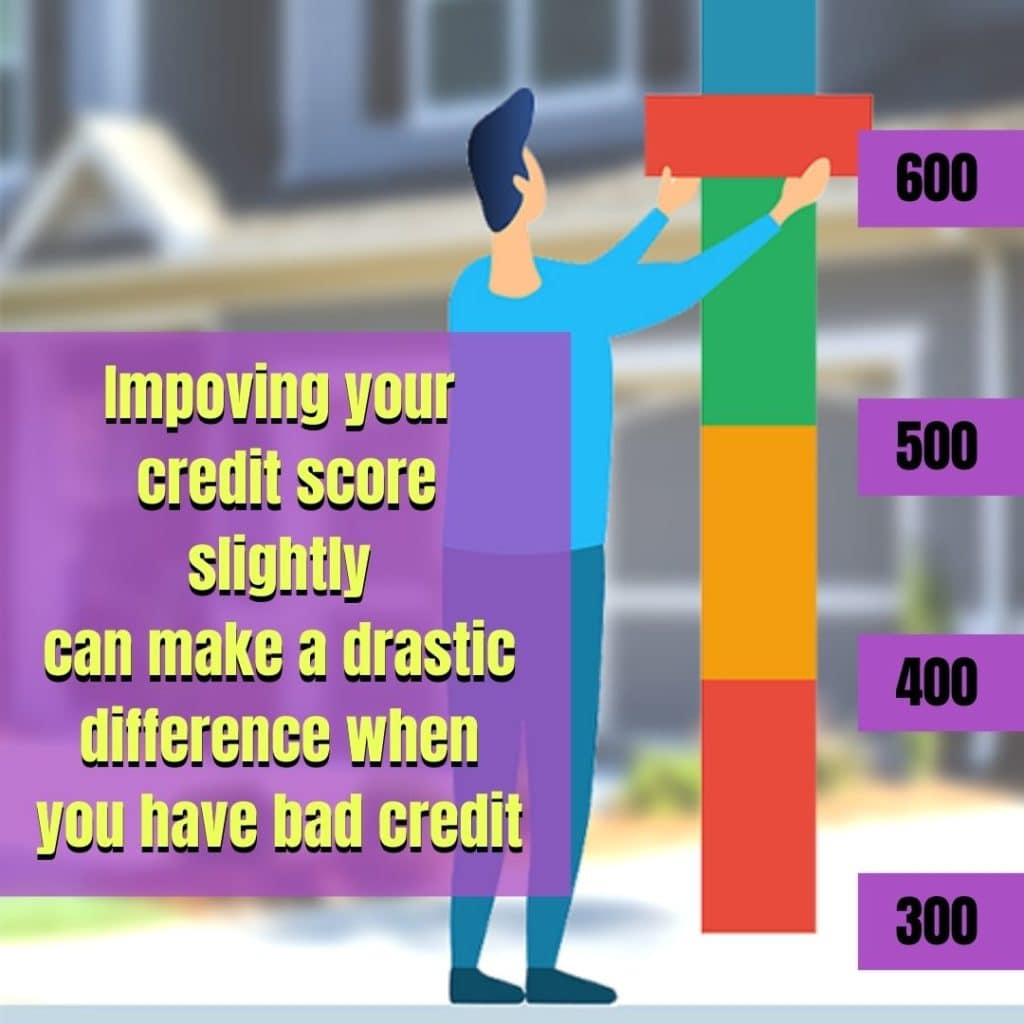

For example, the difference between a 580 credit score and a 760 credit score on a 400,000 mortgage would be about $125,000 in paid interest over a 30 year period. That translates into $347 a month.

Buy A House With Bad Credit

To understand why you have bad credit we need to understand your credit or FICO score.

Banks are looking at several things when you are applying for a home loan. They are called the three C’s.

Credit- Your FICO score plays a large part in your ability to get a home loan with a bad credit score. Approximately every 20 points in credit score will affect your interest rate and the available loan programs to you.

Collateral- How much skin or your down payment you have in the game is important. Many loans can be obtained with as little as 3% down payment. If your credit is bad a bank may require more of a down payment.

Capacity- Capacity is your ability to make the monthly payments on your mortgage. Capacity is measured in the form of debt to income ratio. Your debt to income ratio is your monthly debt in proportion to your gross income.

When if it comes time to get a mortgage, if one of the 3 C’s is out of whack it makes securing a loan more difficult. You may have a good income but bad credit, but the bad credit profile will drag you down.

Where To Start Assessing Your Poor Credit

First and foremost, get your hands on your credit score or FICO score from all 3 major bureaus. Today there are many sources for obtaining your credit score. But it is key to get a report or history of your credit from all three credit bureaus.

Obtaining your annual free credit report from all three credit bureaus in one shot is easy through www.annualcreditreport.com.

Another option is to work with a great mortgage officer. They will help you get a credit report, review your credit and make suggestions to improve your credit score.

What Is A Good Credit Score vs A Bad Credit Score?

- 750-850 Excellent- With excellent credit you have many options and the best interest rates available to you.

- 680-750 Good to Very Good- With good credit you have most mortgage programs available to you with good interest rates.

- 620-680 Bad to Fair- Bad to Fair credit needs a little finesse to find a loan program that works for you and you will be a bit of a premium in interest rates.

- 580-620 Very Bad to Bad- A bad credit score limits your options to government-backed loan programs and you will pay a premium in upfront costs or interest rate.

- 300-580 Abysmal- Very little can be done with bottom tier bad credit scores. If you can find a loan program it will border on predatory. Others in this situation may consider rent to own while they fix their credit.

What Makes Up Your Credit Score?

- Payment history. Payment history makes up 35% of your FICO score. Paying your bills on time is critical. One late payment can ding your credit, but rolling late’s are a death sentence for your credit. Rolling late’s are bills that go unpaid month after month.

- Credit utilization. Your credit utilization makes up 30% of your credit score. Utilization is the amount of available credit you have available to you vs. the actual amount used. Try to keep your credit utilization around 20-30% of your available credit.

- Credit history length. The age of your credit accounts matters. The longer you have had an account the higher your credit score.

- Credit mix. Your credit mix plays a 10% role in your FICO score. A mix of credit is a good….. car loan, student loans, a few credit cards etc…. Stay away from too many installment loans, they are not looked upon favorably.

- New credit. Recently opened credit accounts, as well as the number of hard inquiries made for new accounts, make up 10% of your score. Too many inquiries for new credit may show you are a credit risk.

Assessing Why You Have Bad Credit And Ways To Improve It

It is not unusual for there to be mistakes on your credit report. Go through it with a fine-tooth comb. Make sure the lines of credit are actually yours and are being reported properly.

Dispute any credit report mistakes immediately. Don’t let a mistake put your credit score in the dumpster. Common credit mistakes are lines of credit being reported that aren’t yours, errors in your information and fraudulent activity.

Improving A Bad Credit Score

Most homebuyers are many months or even a year or more away from buying a house. No matter where you are in the process it will benefit you to start improving your credit now, it can make a big difference.

- Periodically review your credit for mistakes.

- Pay your bills on time! Don’t have any more late payment dragging your credit score down.

- Have a mortgage officer run a credit simulator and make an action list that may improve your credit.

- Adjust your credit utilization. If your credit utilization is above 30% overall or on one or more credit lines, consider paying them down. If your credit utilization is at 50% or 75% or more your credit is taking a big hit. You are better off having less of a down payment and paying down some of your credit.

- Ask for a credit increase. If you can’t pay down your credit cards enough (below 30%) ask for a credit increase. If you have a card that has a max of $2000 and you run an $1800 dollar balance ask for a credit increase to get your utilization down.

- Don’t close older credit accounts. Many consumers will close their oldest unused cards thinking it is a good thing. But age matters. Use them sparingly, don’t close them.

- Improve your credit mix. See if there is anything you can do to improve your credit mix. Maybe adding a credit card or a small car loan can improve your credit.

- Ask lenders to remove derogatory credit. If you don’t have a good reason they probably won’t. But, if you have a reason it can’t hurt to ask.

It Is Possible To Improve A Bad Credit Score Quickly

It depends.

I had a client a few years back who raised their credit score 112 points in 45 days. The homebuyer had their mortgage officer run a credit simulator with suggested actions and potential improvement in their credit score.

By removing some derogatory credit and paying down some debt, they were able to have a significant impact. The biggest being removing a derogatory late from their credit report.

While this is significant, raising your credit score quickly depends on your credit profile. Not everyone can impact their credit score with a few adjustments.

For many borrowers raising your score 10-20 points in a short period can have an impact on the loan program and interest rate on your mortgage that you are offered.

In the next segment, you can see raising your credit score from a 618 to a 620 can have a significant impact.

What Bad Credit Home Loans Are Available?

Following is a list of home mortgages available to homebuyers with bad credit thru great credit. These are minimum guidelines but each individual lender will set their own criteria.

When you are shopping for a loan with a poor credit score and low down payment, it is about the loan program that will accept a bad credit score and not so much about the interest rate.

500 to 580 Credit Score- Having a poor credit score in the 500 to 580 range will require you put a home deposit of 10% or more on a home. This limits you to an FHA loan. You will have to search hard for a lender that will consider an lending on a bad credit score in this range.

580 to 620 Credit Score- Again the mainstream loan for a low credit score is the FHA. The good news is the FHA loan program with a 580 to 620 credit score will allow you to put only 3.5% as a down payment. It is also possible to consider a VA loan program (Veterans only)with a credit score down to 580 which will allow a 0% down payment or a USDA loan down to a score of 600.

620 to 680 Credit Score- Your options open up for a poor to fair credit score. Certainly, an FHA Mortgage Program and VA Mortgage Program are available to you. But now you open up conventional mortgage programs like the Home Ready and Home Possible mortgage programs, that allow a minimum down payment of 3%. While a USDA loan may get approved down to a poor credit score of 600 the general minimum is 640.

680+ Credit Score- Most home mortgage options will be available to a credit score above 680. About every 20-40 points in improvement in your FICO score will lower your interest rate.

Massachusetts Mortgage Programs For Bad Credit

There are community lending programs that many banks are required to participate in throughout Massachusetts and other states. A bank must lighten up lending criteria for certain gateway cities to help with affordable housing.

A gateway city are mid-sized urban centers that anchor regional economies but face economic and social challenges. Such cities include Lowell, Haverhill, Brockton, Fall River, etc… They are usually cities that have thrived economically in the past but have fallen on harder times.

Minimum credit scores for community lending can vary greatly. So call your local banks.

MassHousing is a Massachusetts loan program. The minimum credit score is 640 to participate in a MassHousing loan program.

Summary Of How To Buy A House With Bad Credit

It is clear that the government-backed FHA loan program for borrowers with bad credit reigns supreme. But realize, not every lender will have the same bad credit score threshold. You will need to call around and find the right FHA lender.

Buying a home with bad credit is certainly achievable. Another good piece of news is a secured line of credit like a home mortgage can have a positive effect on your credit. Especially if your credit score is poor because of a lack of credit or established credit. I often have borrowers who start with an FHA loan and refinance out in 6 to 12 months into a conventional product.

From the moment you have the thought of buying a house, work on improving your credit…. and don’t stop. Sometimes a small improvement can have a large impact on available loan programs and interest rates.

And most of all pay your bills on time!

Other Real Estate Resources:

- As a first time home buyer your credit may not be perfect. Bill Gassett has some great suggestions for the buyer buying their first home with less than desirable credit.

- Covid-19 has certainly disrupted are lives. One area is how we view real estate. Vicki Moore has provides some insight on why homebuyers are relocating due to Covid-19.

- Having bad credit may prevent you from getting a home mortgage. Paul Sian gives some ideas on some non traditional financing to buy a home.

How To Buy A House With Bad Credit is provided by Kevin Vitali a Massachusets REALTOR for EXIT Realty out of Middleton MA. If you are looking to buy or sell a home in the nortshore Massachusetts area call Kevin at 978-360-0422.