A home seller’s first thought when it comes time to sell is what is my home worth? But no only does a seller want to know what their home is worth but more importantly, how much will they net from the sale of my home.

This is when a homeowner turns towards a REALTOR or a Real Estate Agent to prepare a Comparative Market Analysis or CMA to determine the fair market value of a home.

The single most important thing you need to do when selling a home is to price your home correctly.

Your Comparative Market Analysis or CMA report will use historical sold data to help you determine your home’s correct asking price or list price to get it sold.

What Is A Comparative Market Analysis or CMA in Real Estate?

A Comparative Market Analysis or CMA is a report that uses current and recent historical data to identify similar homes that have sold in a neighborhood to determine the most likely selling price or the fair market value of a home.

The keyword here is data!

A number is not pulled out of the air, it isn’t based on a gut feeling, what your neighbor says it is worth or even what the Zillow Zestimate says your house is worth….

A CMA is based on data.

What Is Included In A Comparative Market Analysis?

Your Comparative Market Analysis should include the following:

Market Overview- Knowing where the current real estate market is and where it is headed will help you price your home accordingly. A failing market points to the fact you should be pricing your home slightly below market to compensate for decreasing home values. Where an appreciating market may indicate you can price a little more aggressively.

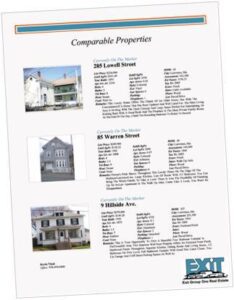

Comparable Homes That Have Sold- Your home will be compared to 3 or more similar sold properties to help give you a range of the pricing of what similar homes have sold for in your market.

Note that a seller can ask any price they want for a home but it is the sold price that indicates what the market is willing to pay.

Adjustments- In an ideal world, we could find 3 homes that are identical to yours that have sold. But in reality, every home is unique. Pricing adjustment will be made to adjust for amenities, appeal and location to either raise or lower the sale price of a comparable home.

Comparable Homes That Are On The Market Or Under Agreement- Homes similar to your home that are currently for sale give you an idea of what your competition will be when you list your home.

Under agreement homes help identify where the market is headed by seeing how quickly homes are having offers accepted on them or days on market. Shorter days on market indicate the market is appreciating, longer days on market could indicate homes are depreciating.

Pricing Recommendations- Finally your CMA will indicate a most likely range your home will sell for based on the sold comparable properties and where the market seems to be heading.

Overpricing your home is one of the biggest mistakes a seller can make. Work closely with your agent to fully understand the Market Analysis for your home.

What Makes A Comparable Home In A Comparative Market Analysis?

A comparable home or “comp” as agents like to say are homes that are identified to be similar to the subject property.

Comparable properties are at the center of a CMA.

While there can be many factors that go into selecting comparable properties. Let’s take a look at some of the more important points of what makes a comparable home in a Comparative Market Analysis.

Timing

First and foremost all the comparable homes need to be currently on the market or under agreement. Sold properties used as comparable homes in your comparative market analysis need to have been sold in the past 3-6 months.

Markets change what a home sold for 6 years ago or even only a year ago has no bearing on what a home is worth today.

The recency of a comparable home is important to keep the comps in a similar market.

Location

Comparable homes should be in the same neighborhood or under one mile from the subject property. Of course, this may not always be possible so then you may have to look for homes in a similar location within the same town.

For example, a home in a neighborhood setting on a cul-de-sac will have more value than a similar home on a busy route.

Size

The comps selected for your CMA report should be within 20% +/- of your home’s size or square footage. It is almost impossible to compare a 3000 square foot home to a 1600 square foot home.

A home that is 1600 square feet will function very differently than a 3000 square foot home.

Room Counts

Room counts should be similar as well as bath and bedroom count for your comparable homes. It is impossible to compare a 5 bedroom 4 bath home to a 3 bedroom 1.5 bath home.

Style and Age

Cape Cod-style homes should be compared to other cape homes and colonial homes should be compared to other colonial homes whenever possible

Compared homes should also be of a similar age. A 1950s colonial will function very differently than a 2015 colonial.

Condition

There would be a large value gap between a 1950’s home that was in original condition vs one that was fully renovated.

It is important your comparable homes are in a similar condition to the home you are selling.

Features and Amenities

Garages, sheds, finished basements, central air, etc… may all add value to a home. Comparable homes should have similar features and amenities to yours.

Function

A lot of what goes into selecting comps is function. Do similar homes function the same way. For example, a 3 bedroom home with 1 bath will function very differently than a 4 bedroom home with 2 baths.

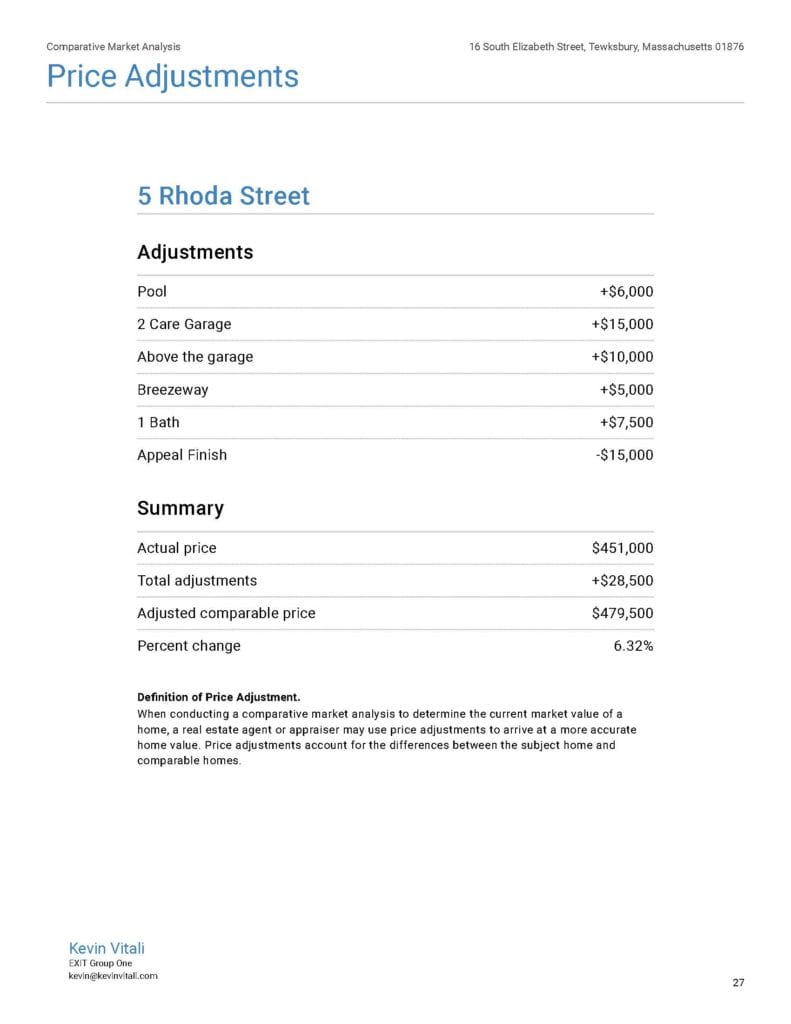

Adjustments On Comparable Homes In A CMA

The similarity of home is crucial in selecting comparable homes for a CMA report. But as I pointed out no two homes are alike, especially in New England.

Adjustments are a vital part of a CMA because of this.

A superior comparable home will have subtractions made to the sale price and an inferior home will have additions. This brings the adjusted sale price more in line with the subject home.

For example, take a subject property compared to the property below. + Adjustments are made to superior features in the subject property. – Adjustments are made where the subject property is inferior to the comparable home.

This gives the comp an adjusted sale price of $479,500 which is used as the comp price for this home.

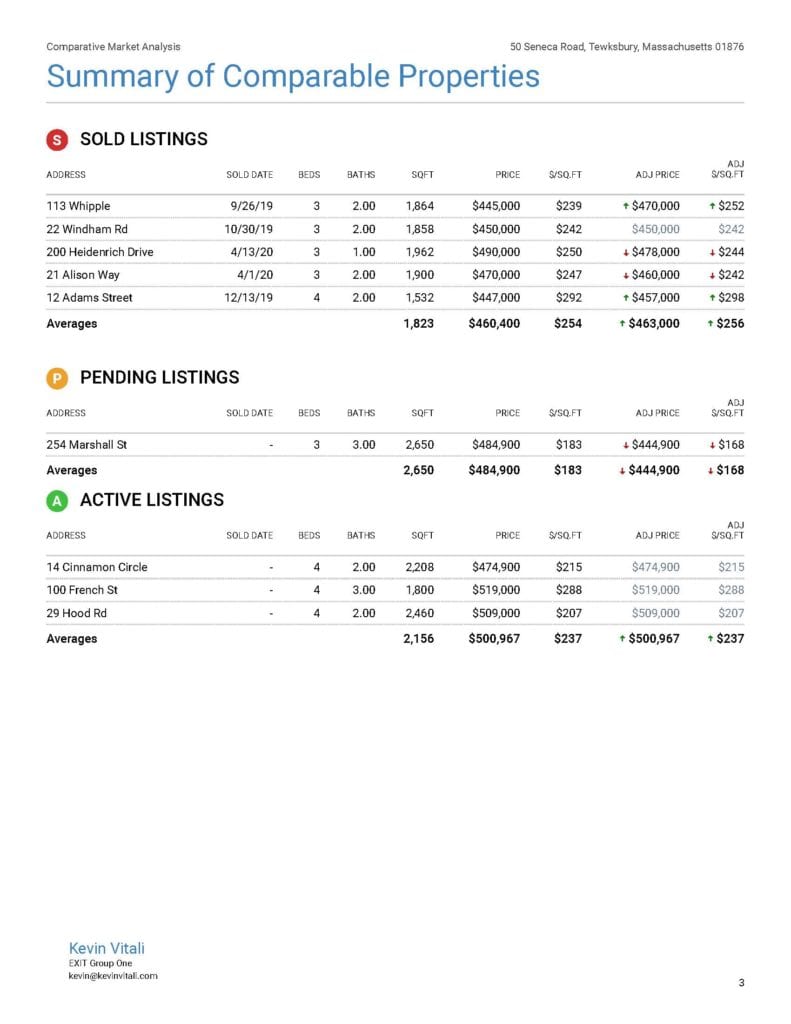

Below is a summary of all the comps used and the adjustments made on another property. The adjusted comps are than all averaged out to give a most likely selling price.

Your Responsibility As A Seller

Don’t blindly accept a price given to you by an agent. And, don’t assume you know what your house is worth without having the data.

It is ultimately your responsibility to choose your list price for your home. It is important to understand the data behind the CMA report.

As a seller, a Comparative Market Analysis is an invaluable tool.

Not only does it assist in getting the proper price for your home it is an key tool to negotiate offers with confidence. You know when you are getting offered a fair price for your home and you can always use the comps as a negotiating tool.

The Difference Between An Appraisal And A CMA

A Comparative Market Analysis is performed by a real estate broker to help determine market value for a home seller to market their home.

An appraisal is a report by a state-licensed appraiser. While an appraisal on a home can be done for lots of reasons it is primarily used for a lender to verify the home is worth what a buyer is paying for it.

While both an appraiser and a real estate use similar techniques and data from the multiple listing service, an appraiser has strict guidelines to follow. This allows for some uniformity for the banks.

A real estate agent or Realtor often mirrors what an appraiser will do when they create an appraisal. can use more subjectivity in the process. One large difference is an agent has no defining guidelines in creating a CMA. More subjectivity can be used by an agent.

Ultimately, when an appraiser inspects a home the process is more data-driven than a real estate agent’s process in creating a comparative market analysis.

Ultimately, whether you get a CMA or an appraisal done on your home you will get similar values.

A Comparative Market Analysis Is Not Just For Sellers

As a homebuyer, you are concerned about paying a fair price for a house and not overpaying.

When you work with a buyer’s agent, often they will suggest preparing a CMA for you. A CMA will give you an understanding of what similar houses are selling for and what the home you are interested in is worth.

The CMA will aide in putting together a negotiating strategy and allow you to negotiate from a position of strength.

A Market Analysis can be useful both to homebuyers and sellers to determine the market value of a home.

Ways Not To Value A Home

When it comes to pricing your home a CMA is the way to go…. or an appraisal. But many sellers turn to other resources that may not be so helpful in pricing a home.

Tax Assessment- The tax assessment is a valuation of your home. But it has a different purpose. It is not to determine fair market value.

Tax assessments are used to fulfill a town’s budget based on the value of your property. While often it can mirror the fair market value of your home it is not a reliable way to determine value.

Zillow or Other Automated Values- The Zillow Zestimate is an automated value model that returns a value for your home.

Unfortunately, it can be quite inaccurate. It does not make determinations on things like location or condition which can influence a home’s value.

What Others Have To Say- It seems like everyone has an opinion on real estate and what a house is worth. But would you go to court without a lawyer?

Hire a trusted professional that is in the business on a daily basis.

Summary

A Comparative Market Analysis is a staple in the real estate industry for agents to guide sellers in choosing a list price for their home.

There is a method and reason on how to determine a price for your home. And that is by comparing recently sold data of comparable homes. At the end of the day your home will most likely need to appraise for the purchase price or higher for the bank financing your buyer. Otherwise, a bank will not lend on your home.

Get a CMA report from several different agents to compare the data. Hopefully, all the CMA’s will be within a few percentage points of each other. If there is a big swing be prepared to ask questions and why.

Two final thoughts.

First, a home’s value is a range and not just one number. Often a seller fixates on one number and can miss a good opportunity to sell their home over a few thousand dollars.

And, a home value from a Comparative Market Analysis is good for that window of time only.

If you list your home 6 months after reviewing a CMA, get a new one. Real estate markets can change on a dime and a value from six months ago can be different from the one today.

Other Resources:

- When you list your home for sale, realize your house is competing with other homes. Vicki Moore has some great tips on making your home stand out from the competition.

- Are the home values you get from Zillow accurate? Probably not. Kyle Hiscock explains why you should not rely on the Zillow Zestimate as an accurate way to price your home.

- Not every home renovations adds value to your home and if done poorly can detract from your homes value. Anita Clark discusses 14 mistakes homeowners make when renovating their house.

The Comparative Market Analysis (CMA) was written by Kevin Vitali of EXIT Realty. If you are thinking of buying or selling a home call Kev in at 978-360-0422