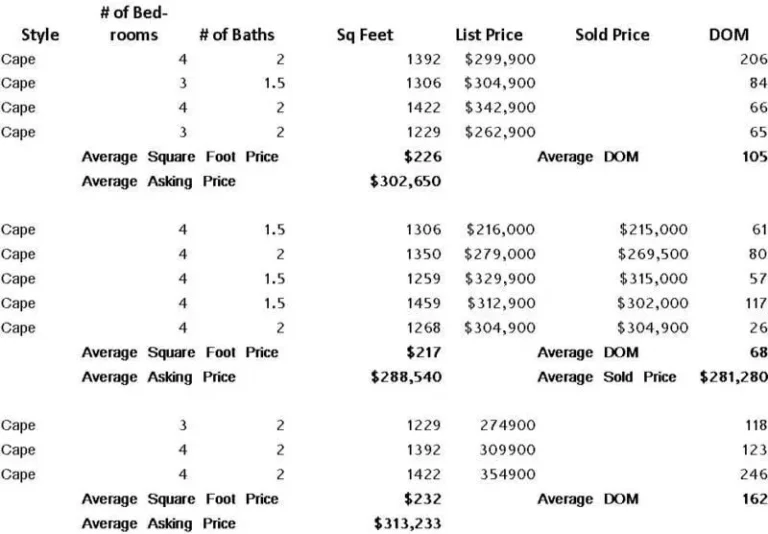

The Comparative Market Analysis (CMA)

A Comparative Market Analysis or CMA use comparable homes to help sellers determine an asking price for their home. A CMA is prepared by a local real estate agent and a homeowner should call their REALTOR to get a Market Analysis before listing their home.