Home Buying Guide: Put The Process To Work For You

If you are a first-time homebuyer or haven’t bought a home in a while, it might be time to step back and look at the home buying process and the home buying process timeline.

Having an understanding of how long it takes and the steps it takes to buy a home will help you make a successful home purchase. Have you ever heard the saying knowledge is power? Well, that is also true when buying a home. The more you put into the more you will get out of it.

Of course, the home-buying process has many twists and turns and the experience is different for everyone. An experienced REALTOR acting on your behalf as a Massachusetts Buyers Agent can help navigate the home buying process while looking out for your best interest.

Jump To A Section....

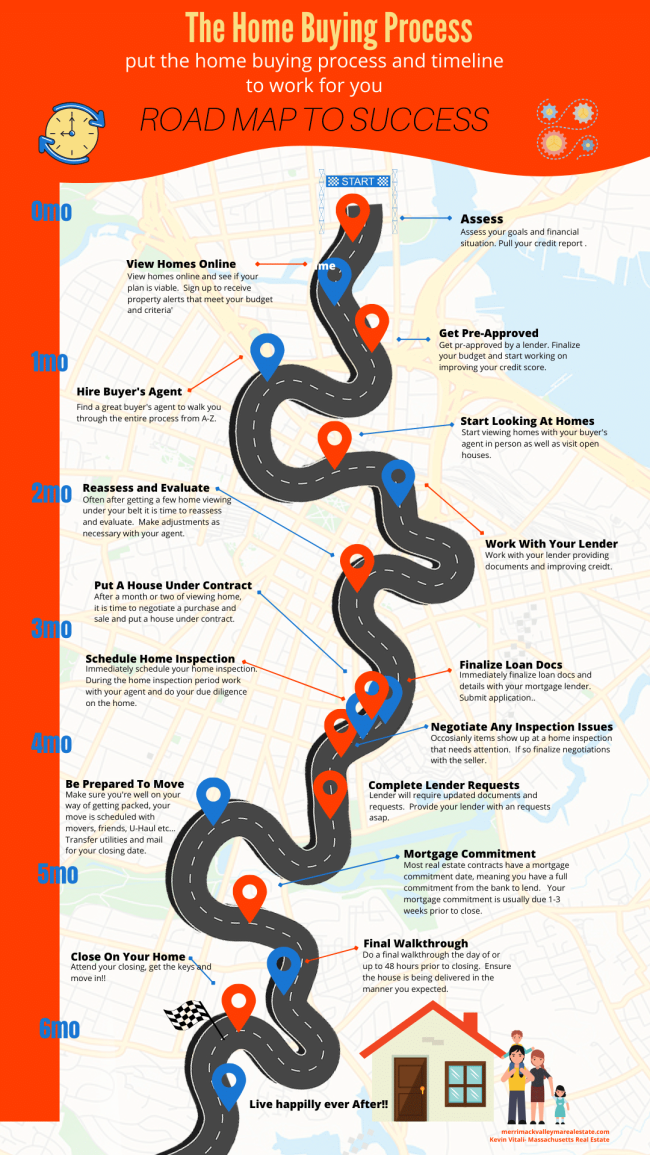

How Long Does It Take To Buy A House?

How long the home-buying process takes depends on your individual circumstances. The following is a rough timeline to help you give context when buying a home.

For most homebuyers, the home-buying process takes 4-7 months. But, realize it can vary drastically depending on your individual circumstances.

Many home buyers come to me and say they want to be in a house in 2 months. Clearly, they have not thought the process of buying a home through.

Two months is not a realistic timeline, especially if no leg work has been done. If you came to me today, the quickest I can probably get you into a house is in 2.5 to 3 months.

Figure you have a month or two of some pre-planning before you even look at your first house. Most people just don’t wake up and decide they are going to buy a house that day.

Then you have 1-3 months of actually looking at homes that might suit your needs before you put in an offer.

Depending on inventory levels and if you are moving up to a bigger house you can easily spend 4-6 months looking for a home stretching out the buying process.

And finally, once you put a house under agreement you have 30-60 and possibly up to 90 days in escrow before you sign on your new home.

The Home Buying Process- What Are The Steps to Buying a House?

The steps to buying a home are broken down into 3 distinct stages. They are pre-planning, finding a home and escrow.

Pre-Planning- 0-2 months

Starting off your journey with pre-planning is a critical step of the home-buying process that should not be overlooked. Our home buying process flow chart certainly simplifies things but here are many things you can do to get ready to buy. The more pre-planning you do the better your final outcome will be.

Assess Your Situation

You get the thought you want to buy a house. It is time to think about where you are at and where you want to be. Think about if this is the right time for you to buy a house and if you are ready to set roots and settle into an area. Are you ready to stop renting and invest in a home?

Is selling your current home and buying a new one feasible?

There are certainly many questions to ask yourself before pulling the trigger and deciding it is time to buy a home.

Review Your Finances

If you are a first-time homebuyer you may want to own a home but there are financial responsibilities that are not easy to unravel when you own a home. In many cases, you will find a mortgage may be about the same as renting a home.

If you already own a house you need to figure out how much your home is worth and more importantly how much you will net from the sale of your home to go on to buy a new one.

Analyze Your Credit Score

Your credit score has a lot to do with buying a house. Upon getting the thought to buy, pull your credit score. Check for mistakes and see where you may be able to improve your credit score quickly. While going through the home buying process you may have the ability to raise your credit score and put yourself in a more advantageous position to get a mortgage.

You can certainly buy a house with bad credit, but every 20 points of credit score can improve your ability to qualify and drop your interest rate.

Find A Great Buyer’s Agent

In the pre-planning stages of the home-buying process, find a great buyer’s agent to walk you through the process. A buyer’s agent can help you with the pre-planning, identify homes that may work for you, help you structure a winning offer, keep your financing on track and much more.

A great buyer’s agent will help you walk effortlessly through the home buying process and put the process to work for you.

Get Pre-Approved

Once you make the decision to buy, get pre-approved by a mortgage lender. A pre-approval is a review of your income, assets and credit. It will give you confidence through the home buying cycle. You will know exactly what a house will cost you in monthly mortgage payments, how much you need for a down payment and the closing costs associated with obtaining a mortgage.

A pre-approval will avoid any last-minute financial surprises. Get pre-approved before ever looking at homes.

View Homes On-Line

Viewing homes online helps you establish whether buying a home is viable based on your budget. It will help you see what is available for your budget and formulate your wants and needs.

If you have $500,000 to spend in Massachusetts, your $500k will get you very different homes in Tewksbury, Haverhill and Andover. You will get much more home $500k than you will in Andover. Tewksbury will fall somewhere in the middle.

Finding A Home 1-3 months

Now that you have taken the time to get your financial house in order, have an understanding of the process, and have an idea of what is available to you it’s time to get your feet on the ground.

View Homes

Now is the time to start doing drive-bys, visit open houses and schedule showings with your buyer’s agent. Homes will show very differently than they look online.

In the beginning, don’t be too picky. Go see homes!! Every home you get under your built helps you narrow down what is out there and what will actually work for you.

Work On Financing

During this time period, work with your mortgage lender. Get your application and documents ready to go for when you find the perfect home.

Continually work on maintaining and improving your credit. I had a client once improve their credit 110 points in 45 days. It is possible. In the end it will save you money. Your mortgage lender will make suggestions that could improve your credit.

Re-assess and Make Adjustments

It is not unusual during the home-buying process to come to the table with certain ideas and thoughts. Only to later realize maybe they weren’t realistic or what you want doesn’t exist.

Buying a home is often about compromises. Work with your agent and decide if you need to make some adjustments to your home search. It may be looking in a lower-priced area, readjusting your price range, or changing your expectations. It’s part of the home-buying process.

Negotiate A Contract When Buying a House

After spending some time visiting a variety of homes it is probably time to pull the trigger on making an offer on a home. Most home buyers are ready to buy a home after viewing 5-12 homes.

Of course, there are buyers who view many more homes. Realize that after you have seen 5-10 homes in a certain price range in a particular community what comes on after that will be very similar.

There is a balance between finding the right home, but not taking so long as the market could appreciate significantly. For example, one market I do a lot of business in is Haverhill MA. For the past two years, we have seen an appreciation of 7 to 9% a year. Every month that goes by you lose buying power.

Once you make an offer, negotiations are usually quite quick and will be wrapped up in 24 hours or less.

Now you have a house under agreement. You are now in a legal and binding agreement and you have a home deposit at risk. Make sure you understand your contracts and are prepared to perform.

Escrow 1-2 months

Escrow is the period of time between putting a home under contract and closing on the home and getting keys so you can move in!

The escrow period starts off a little chaotic. Once you get a home under contract there are a bunch of tasks you need to complete right away.

It is important to stay on task during the escrow period. You are under contract to perform and if you don’t you can lose your deposit money.

Schedule Your Home Inspection

Your home inspection contingency is for a very short period. You need to immediately schedule your home inspection and get it done. Consult with your buyer’s agent. They should be able to refer a good home inspector to you.

Finalize Your Loan Application

As soon as you get a home under contract make sure you call your lender and finalize your loan application. Hopefully, your application is all ready to go.

Negotiate Any Home Inspection Repairs

Once your home inspection is complete, you may find some areas of concern. You may consider negotiating repairs, a price reduction, or a closing cost credit to compensate you for the areas of deficiency in a home.

Complete Lender Requests

The mortgage process is a nerve-wracking one. There will be requests for updating documents or resending documents you already sent.

A one-day delay on your part can translate into a bank delay of several days. Stay on top of the lender’s requests and be diligent.

Be Prepared to Move

2-3 weeks before your closing make sure you are well on your way of being packed and ready to move. Confirm your moving date with your movers or truck rental company.

This is a good time to have your mail transferred and all the utilities transferred to your new address as well.

Mortgage Commitment

Mortage commitment signifies your mortgage is officially approved. You must notify the seller if it is not approved as spelled out in your purchase contract.

If not approved, you either need to ask for an extension or pull out of the deal. Talk with your lender and real estate agent to see what is outstanding and where the issue may lie. It is not unusual in this lending environment for mortgage commitments to be delayed.

Final Walkthrough

You want to schedule your final walkthrough just prior to closing. The final walkthrough is your chance to make sure the house is being delivered as expected.

After closing on your home you will have no recourse. You are signing you are accepting the house as-is. Don’t skip your final walk-through.

Close On Your New Home

Finally, you have reached the finish line. You have worked hard to get to the closing table. It is time to hit the attorney’s office and sign all of the loan documents and get the keys to your home.

Understanding The Role Of A REALTOR When Buying A House In Massachusetts

A real estate agent plays a crucial role in the home buying process in Massachusetts. Real estate agency is a complex aspect of buying a home and it is important that you know who your agent is working for. The only agent that works in your best interest is a buyers agent.

They possess extensive knowledge of local markets, help buyers find suitable properties, negotiate offers, and guide them through the paperwork involved. Working with a trusted real estate agent can streamline the process and provide valuable insights and advice.

They serve as your advocate, representing your best interests throughout the transaction. A Massachusetts Buyer’s Agent can walk you through the home buying process from A-Z. Here are just some of the tasks an agent representing you can help you with.

· Determining if now is the right time for you to buy a home.

· Give you an overview of the home buying process.

· Help you create a realistic budget.

· Help secure financing for your new home.

· Explain closing costs.

· Identify your wants and needs.

· Explain current market conditions and how it effects you.

· Identify homes that fits your wants and needs.

· Show you homes you are interested in.

· Help assess the homes based on your wants and needs.

· Construct a negotiating strategy once you find a home to purchase.

· Write a winning offer.

· Negotiate and advocate on your behalf.

· Help with due diligence on the home.

· Co-ordinate all the vendors involved in closing.

· Help schedule a home inspection.

· Negotiate any inspection issues.

· Continue coordinating the closing.

· Schedule final walk through.

· Closing day!!

· And much, much more…

Summary

Buying a home takes time and some effort. I have outlined the basic steps of the home buying process for you. Make the buying process work for you.

Each phase of the home buying process gives you time to prepare for the next step so there are no surprises.

Finally, remember the home buying process is highly individualized and I have only spelled out the basics. Working with a good buyers’ agent will help you fill in the gaps that you personally need and put the process to work for you.When House w

Do I need a real estate agent to buy a house in Massachusetts?

Should I get a home inspection when buying a house?

What must a Massachusetts seller disclose to a home buyer in Massachusetts?

Can I negotiate price on a home?

How long does it take to buy a home from start to finish?

Author Bio

Kevin Vitali is a Massachusetts REALTOR out of Haverhill MA that serves Essex County and Northern Middlesex County in Massachusetts. If you want to buy or sell a home, let me use my years of experience to get you the best possible outcome.

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com