You don’t have to buy your first Massachusetts home alone. Some great real estate professionals help you get the job done. Your real estate team will include a REALTOR representing you, a mortgage broker, a home inspector and a real estate attorney. All the professionals have the experience to guide you effortlessly through purchasing your first home. They are immersed in real estate daily and can use their experience to help you.

We will talk about the 5 critical first steps you should take before ever looking at a home as a first time home buyer in MA. Included are some othe

These first steps will help lay a great foundation for your home buying experience. Leaving you with a great house you can afford for many years to come.

Jump To A Section....

Outlook For Massachusetts Real Estate Market 2024

2023 presented many challenges and concerns for first-time home buyers in Massachusetts. Topping the concerns were high interest rates and a lack of inventory.

The good news for 2024 is housing is still appreciating in Massachusetts and will hopefully entice sellers to enter the market and increase inventory levels.

More importantly, interest rates are in the low to mid-six percent range. And the Fed is expected to have 3-6 rate cuts this year as inflation comes under control. 2024 may see rates in the 5% range this year, creating an exciting opportunity for first-time home buyers.

The 5 First Steps for A Massachusetts First Time Home Buyer

Many FTHB’s will start by looking at homes first, which is putting the cart before the horse.

When you do that you will stumble through the process and deal with various aspects of the process and hurdles unprepared while in a panic as they arise.

Take the time to be fully prepared to buy your new home in Massachusetts. This means spending some time preparing before looking at homes. Being a first-time home buyer in MA is hard enough and if you take the proper steps you won’t feel as rushed or panicked.

Hire a Massachusetts Buyer’s Agent

A Massachusetts Buyer’s Agent can wrap their arms around the whole process for you. From helping you to make the decision to buy, getting financed, evaluating homes, making an offer and bringing you to a smooth closing as well as make sure you are settled into your new home, Your buyer’s agent experience will be an invaluable tool when buying a Massachusetts home.

An agent working with you in Massachusetts can work with you in several capacities. But, a buyer’s agent is the only agent that represents your best interest. One huge first time home buyer mistake is working directly with the listing agent to buy a home.

The listing agent does not work for you, they work for the seller. Their job is to get the best terms and price for the seller’s home, even if it is at your expense.

Finding the right REALTOR to work with you as a buyer’s agent can save you time, money and aggravation. I always tell buyers they don’t know what they don’t know, but a good buyer’s agent does. They will also walk you seamlessly through every step of the process.

Get Preapproved

Getting a good mortgage pre-approval letter will have many benefits. Your buyer’s agent can help line up a few mortgage lenders for you to speak with.

A mortgage pre-approval will help you understand the money involved for the purchase as well as your monthly financial obligation that comes with buying your first home. Your lender will find the best first time buyer loan program that will suit your needs.

When it comes time to make an offer on a home, no seller will take you seriously without providing them a solid mortgage pre-approval letter.

There are other benefits to getting pre-approved early. You will have time to fix any credit issues and raise your credit score. Every 20 points your credit score goes up there could be a benefit for you.

You also have started your application and you won’t be scrambling around at the last minute pulling together your financing on your new home.

MA First Time Home Buyers Need To Understand the Money Involved

There is a lot of money at stake. Buying a home is probably one of the largest transactions you will make have in a lifetime.

Make sure you understand the money that is involved, so there are no surprises at closing. Not only do you have your down payment, you will also need money for closing costs, escrows and pre-paids.

By getting a proper pre-approval you will also be able to have real conversations with your mortgage broker and real estate agent about your monthly payment, getting the best interest rate and mortgage program.

But past getting your first mortgage and getting to the closing, think about your immediate needs. Here in New England, you might need a lawnmower a snowblower and some other basic items around the house. You need to budget for these items so you aren’t caught short.

Your buyer’s agent will work with you to understand the financial aspect of buying a home.

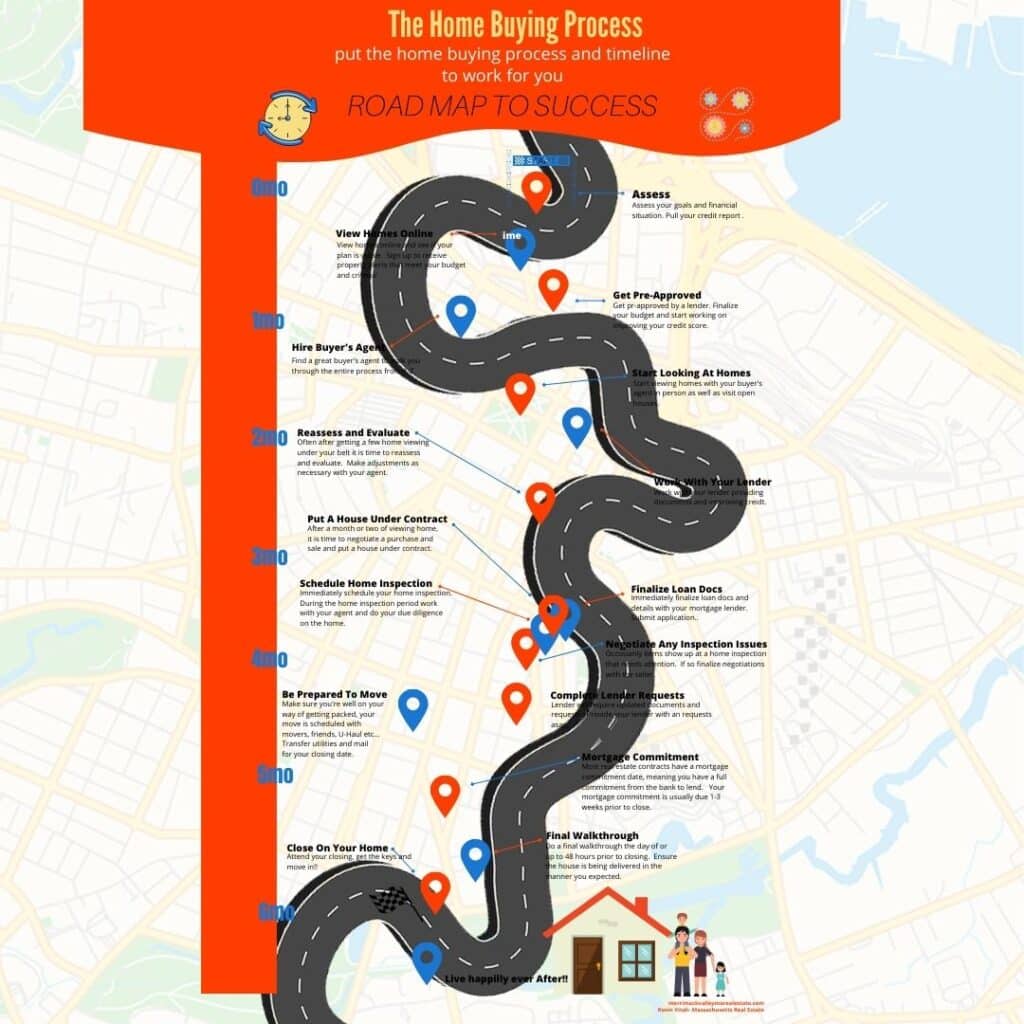

Take The Time To Understand The Process As A FTHB In MA

Make the home buying process work for you as a Massachusetts FTHB.

There are many moving parts to the home buying process and having a basic understanding of the process will certainly make your first purchase go much smoother.

Remember, hiring a Buyer’s Agent in Massachusetts before doing anything else will head you down the right path.

Every transaction is different and hiccups can happen along the way. Here is a quick overview of the basic process.

- Hire an agent- But hire the right agent. Use a Massachusetts Buyer’s Agent who works for you.

- Get Preapproved- Have a mortgage lender pre-approve you early, It allows you to understand the money involved in buying your first home. Start discussing different loan options so you can find the right program for your situation.

- Understand the financials in buying and owning a home. There is more to owning a home than down payments and closing costs. Consider ongoing maintenance costs as well.

- Budget. Lenders will most likely approve you for more money than you are comfortable spending on your monthly mortgage payments. Take the time to understand your debt to income ratio and how that impacts your ability to repay your mortgage.

- Understand the homebuying process. There is a process to buying a home in Massachusetts. Make the process work for you.

- Understand market conditions. Right now we are in a red hot seller’s market, by understanding market conditions you know how to look for homes, negotiate offers and how conditions affect your purchase.

- Work on improving your credit score. Every little bit helps when getting a mortgage. Small changes to your credit profile can sometimes have a big impact.

- Identify homes you would like to see. Your agent can provide you tools to find the best homes as well as provide a second pair of eyes.

- Schedule showings. A Saturday afternoon of 3-5 showing requires some work. Your agent can take that burden from you and maximize your time.

- Find and analyze a home that best suits your needs. Being focused is important. It is easy to be all over the place and you miss the best opportunities.

- Write an offer. Your agent will help you structure a strong offer.

- Negotiate an offer

- Offer accepted

- Start the mortgage process

- Find the right first time home buyer loan. You will have many options and your agent will hlpe you sort through your mortgage options.

- Do your due diligence on a home. Your agent will help you schedule the proper inspections so you ensure you are buying a great home.

- Inspect the home for Radon

- Pest Inspection

- Have an attorney review contracts.

- Manage the transaction to a smooth closing. There are many steps to closing on a home and your agent will oversee those steps.

- Final walkthrough

- Close on a new home. Your agent will go to your closing and ensure no last-minute issues.

- Move into your home. Your agent will not abandon you after you move in. They will be there to answer any questions you have.

Understand The Market Conditions You Are Entering As a MA First Time Home Buyer

The final step for prospective buyers is to have an understanding of current real estate market conditions before ever looking at homes. Market conditions dictate the pace you need to work at, the amount of competition you will have from other buyers, how you view homes and how you structure and negotiate an offer.

Take the greater Boston area in 2020.

It was a strong seller’s market. Inventory is very low, prices are appreciating and there are more buyers than there are homes for sale. You need to get into good homes fast and present your best offer immediately.

The sellers are in the driver’s seat.

Contrast that to 2009. Inventory was high, prices were depreciating and houses were lingering on the market there were more houses for sale than there were buyers.

Buyers were in the driver’s seat and could work at a much more leisurely pace.

Not understanding market conditions can be like pushing a two-ton boulder up a hill. Especially if you are in a seller’s market. By understanding current conditions you will work the home buying process to your benefit.

These critical 5 steps to buying your first home in Massachusetts will ultimately save you time, money and aggravation. It will allow you to make good decisions and find a house that you can enjoy for many years to come.

How Much Of A Deposit Do I Need To Buy My First Home?

One big question I get from people exploring their options to buy as a first time home buyer in Massachusetts is how much of a home deposit do I need to put on a house.

For most buyers buying their first home, a minimum deposit or down payment will be in the 3-5 percent range of the purchase price. There are a handful of programs that may allow you to put less down but are limited and hard to find.

Can A Massachusetts First Time Home Buyer With Bad Credit Buy a Home?

If you are a first-time homebuyer with bad credit, it is still possible to buy a house. It is easier than you think to purchase a home with bad credit. While you may have some challenges along the way and end up paying a little more for your mortgage, don’t give up on owning a home because of less-than-stellar credit.

FHA government-backed program is a perfect loan program for borrowers with bad credit. FHA loans can offer mortgage products down to a 580 credit score.

First Time Home Buyer Programs

If we are talking about first time home buyers in MA, you should be aware of loan programs that may be ideal for the first-time home buyer when you start talking to a mortgage broker. It will also serve you best if you talk to a mortgage broker vs a bank. A mortgage broker will have more options than a bank.

Not all, but many Massachusetts FTHB’s are needing a low money down program. Many Massachusetts loan programs can have a down payment as low as 3% of the purchase price. Some of the loan programs available to a MA first time home buyer are:

FannieMae Home Ready Loan Program

The Home Ready Mortgage provides flexibility for the low money down borrower. Borrowers can but as little as 3% down. It can be a great loan product for a Massachusetts first time home buyer. One advantage of the Home Ready mortgage is the ability to use non-traditional income sources and flexibility with non-occupant co-borrowers.

FreddieMac Home Possible Loan Program

The Home Possible Mortgage is similar to the Home Ready program with allowing as little as 3% down. One advantage of the Home Ready Program is homes in a certain census tract may be eligible for a lower interest rate.

FHA Loan

The FHA loan is a 3.5% down payment program. While it has higher upfront costs it offers a great interest rate and greater flexibility on lower credit scores and debt to income ratios.

MassHousing Loan

When discussing Massachusetts’ first time home buyers the MassHousing mortgage program should be brought up. It is available to first time buyers who are Massachusetts residents.

While it has it pros and cons but there are a few advantages. First, it offers mortgage payment protection if you should lose your job.

And, secondly, it is a great way to tap into downpayment assistance programs of up to 5% or $15,000.

VA Loans

A VA mortgage is a great Massachusetts first time home buyer loan program if you currently serve or have served in the armed forces. One benefit is that it is a 0% down loan program.

USDA Loans

The USDA loan program isn’t great for the greater Boston area. It is a loan product designed for rural areas. But as you stretch out past route 495 it could be an option. One of the great aspects of a USDA loan is the ability to have no down payment.

If you are a MA first-time home buyer, don’t be afraid to discuss these mortgage options and find the right Massachusetts First Time Home Buyer loan program for you.

Find A First Time Home Buyer Class in Massachusetts

Some loan programs like the MassHousing, HomeReady and Home Possible will require you to take a first-time home buyer class.

Outside of it being required by a loan program, taking a first-time home buyer class could be beneficial to anyone deciding to buy their first home. The classes can sometimes be taken online or in person. The FTHB classes will cover much of the information discussed in this article but in greater depth.

First-time home classes in the Northshore and Merrimack Valley are provided by:

- Community Action Inc., Haverhill MA

- Coastal Homebuyer Education, Newburyport MA

- Community Teamwork, Lowell MA

- Lawrence Community Works, Lawrence MA

- Lynn Housing and Neighborhood Development, Lynn MA

- Merrimack Valley Housing Partnership, Lowell MA

- Harborlight Community Partners, Beverly MA

- Gloucester Housing Authority, Gloucester MA

Or to find a course anywhere just google first-time home buyer courses near me or Find a first time home buyer class in Massachusetts on the MHP website.

First Time Home Buyer Grants in MA

Many cities in MA offer down payment assistance and grants to first-time home buyers. For example, Haverhill MA has first time home buyer down payment assistance in certain census tracts in the city.

There are gateway cities that offer down payment assistance to encourage community development. Gateway cities are usually small, older cities that were in their prime before the great depression but saw an economic decline as manufacturing dried up.

Cities in Massachusetts that are considered gateway cities are Attleboro, Barnstable, Brockton, Chelsea, Chicopee, Everett, Fall River, Fitchburg, Haverhill, Holyoke, Lawrence, Leominster, Lowell, Lynn, Malden, Methuen, New Bedford, Peabody, Pittsfield, Quincy, Revere, Salem, Springfield, Taunton, Westfield, and Worcester.

The grants and programs are often tied to your income and require you to use specific lenders. Many communities offer $10,000 as a soft second to help fund your down payment and closing costs.

A soft second is usually a subordinate mortgage, often interest-free, that has deferred payments until you sell your home. In some cases, the loan may be forgiven if you live in your house for a certain period of time.

Make sure you check with your city to see if there are any first time home buyer grants or down payment assistance available to you.

Search For A Massachusetts Home As A MA First Time Home Buyer

It’s easy to search for a home in Massachusetts.

You can use sites like Zillow, Trulia or Realtor.com which provide a national database of homes for sale.

Or, use any agent’s website that provides direct access to the Multiple Listing Service in Massachusetts.

The critical point is that all the sites pull the data from the same sources. All the sites have the same homes for sale. It will be in your best interest to utilize a home search site you like and make sense to you. Learn how to use the site effectively, instead of bouncing from home search site to home search site.

Summary

If you are starting your journey as a first-time home buyer in Massachusetts, these steps will start you on the right path.

The amount of effort you put into the buying process will reflect in your ability to find a great home and have the process work well for you.

You will also be fully prepared and there should be little or no surprises along the way.

Other First Time Home Buyer Resources:

- Dual Agency is a type of agency where an agent represents both buyer and seller. Bill Gassett explains why a first time home buyer should never use a dual agent.

- Luke Skar offers 18 FTHB tips. One great tip that Luke offers is never skipping the home inspection. The home inspection is important to buying a safe and sound home.

- When you are looking for a home, you may find a property go under agreement and come back on the market. Paul Sian explains the most common reasons a home may come back on the market.

- Getting preapproved is an important first step in buying a home. Petra Norris gives us 5 reasons to get pre-approved

Author Bio

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com