When it comes time to list your home the first question you’re going to ask is”how do I determine the value of my home?“

When it comes time to list your home the first question you’re going to ask is”how do I determine the value of my home?“

There is nothing more critical than determining the correct price for your home. There are serious consequences to overpricing your home and letting it linger on the market unsold.

Three Ways NOT to Determine Your Homes Value

First, let’s take a look at three ways that home sellers use to try and determine their home’s value. But, in no way are these three methods accurate in determining the value of your home.

Zillow Zestimate to Determine Your Homes Value

Homeowners will often turn to the popular Zillow Zestimate to determine the value of their home just prior to selling. The Zillow Zestimate just is not all that accurate. It can be off 30% or more in either direction.

Why? You have removed the common sense element and have allowed a computer to analyze the data. The problem is the Zillow Zestimate algorithm does not work the same way a certified appraiser determines value. As Bill Gassett states the automated value system does not think for itself. It cannot make a determination on the neighborhood, differentiate the function of the home, etc…

Tax Assessment to Determine Homes Value

Your home’s assessed value is again another poor way of determining what your home is worth in the current real estate market. Your home’s assessed value is used to fulfill a town’s budget with a totally separate agenda. Assessed values can be as much as 50% off in either direction of your homes true value.

Really, that is the sole purpose of your town’s tax assessment on your home, not for you to determine what your home is worth in the real estate marketplace.

Your Neighbor’s Opinion to Determine Your Homes Value

When a home is listed in the neighborhood you always get feedback from the neighbors on how you listed your home too low or how it sold quickly too quickly to be priced properly.

There is always that one neighbor who seems to know it all and often is misinformed about what things sold for in the neighborhood. They always seem to remember the list price and not the sold price.

Remember your neighbors have a vested interest in you selling high because it drives up the value of their homes. But if you list too high you are testing the market for your neighbor but at your expense!

So How Do You Determine Your Homes Value

So How Do You Determine Your Homes Value

What you are really doing when determining your properties value is determining your homes fair market value. Fair market value (FMV) is an estimate of the market value of a property, based on what a knowledgeable, willing, and unpressured buyer would probably pay to a knowledgeable, willing, and unpressured seller in the market, as determined by Wikipedia.

In most cases, this is done with a Comparable Market Analysis provided by a licensed real estate agent. Or in some cases, a certified appraiser will be used to provide an appraisal.

Since most home buyers finance their purchase, the banks use a certified appraiser to make sure the property value aligns with the purchase price. Because an appraisal is the final determination of value a real estate agent will mirror what an appraiser does to determine your home’s value.

At the end of the day, the value of your home is determined by historical data combined with a little bit of intuitiveness on the agent’s or appraiser’s part. Remember that fair market value is a range. In most cases, it is not an exact number. It is perfectly acceptable for two appraisals of the same property to have a spread of 5% or more.

Value is not always black and white and there is a little bit of subjectiveness involved with the person creating the value report. But, historical sales data is still the most important driving factor in determining your home’s value.

What Is Most Important When Determining the Value of My Home

To help you determine the value of a home it is important to understand how a listing agent and ultimately a real estate appraiser will assign value.

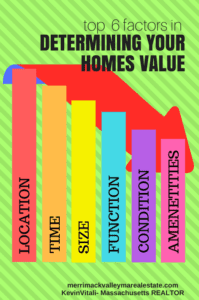

Listed are some of the most important criteria that go into pricing your home for the current real estate market. Note, that they are listed in order of importance!!

When talking about comparable homes, we are talking about sold homes. Any seller can list a home for any price but it is the homes that have actually sold that matter.

Location of Your Home

#1 criterion in determining your home’s value is the location of your home. You cannot compare one town to another. Ideally you want homes that are located in your neighborhood or similar neighborhoods. Appraisal guidelines from the bank are very strict to keep comparable sold homes with in one mile of the subject property.

Take Andover MA. While there are many different neighborhoods in the Andover MA real estate market, we will discuss the Downtown vs West Andover. If you took two identical houses and place one in similar neighborhoods in West Andover and Downtown Andover, the downtown Andover location would have a premium of 5% or more.

Downtown Andover is coveted for its close proximity to schools, the main street and its idyllic New England charm. West Andover while sporting newer neighborhoods, provides quite a drive to get to the central hub of Andover. In this case you would try not to compare one location to the other.

Location not only covers town or where it is located in the town but also the function of that location. You do not want to compare a home on a cul-de-sac to one located on a busy thoroughfare.

Timing of the Sold Comparables

How recently the comparable properties sold is very important. Fannie Mae guidelines suggest comparable properties must be under 12 moths old, but it is preferable that properties that sold in the past 1-6 months be used. A appraiser cannot go past the 12 month period. It does not matter what something sold for 2 years ago 10 years ago. They cannot be used as comparable properties.

The Size or Square Footage of Your Home

When searching for comparable sold properties the size of your home is very important. Your size is determined by above-grade, livable and heated space. Finished basement are an improvement that is not considered in the base square footage. A finished basement would be an adjustment under amenities, as described below.

Basically the square footage is taken by measuring the outside foundation dimension then if you have 2 floors it would be doubled. You must also you must take into account pitched roofs, like on a cape, where not all of the second floor space is “livable” or even overhangs where there may be an extra foot or two in the dimensions on the second floor.

Again appraisers are locked in to using homes that are within +/- 25% of the square footage of the subject property. It is just not practical to compare a 1400 sq foot home to a 2800 sq foot home.

Function of Your Home

The basic functions are room count, bathroom count and bedroom count. It is generally not prudent to compare a 1 bathroom home to a 3 bathroom home even in the same size range.

Function goes beyond room counts. Ideally the style and age, among other criteria help define the function of your home. Generally you don’t want to compare a cape to a colonial. They just don’t usually function the same.

Just as you try not to compare a 1962 Colonial to a 2015 colonial unless there has been updates to modernize the floor plan of the older colonial. If it all possible you want to try to keep your comparable solds to the same era.

Condition

Condition is another criteria that can play a huge factor in how you would determine the selling price of your home. Lets look at two identical house in the same neighborhood. Both built in 1990 by the same builder with the same floor plan.

Neighbor #1 has kept his house for 27 years without doing a thing. Carpets, kitchens and bath are starting to get worn and dated. No upgrades have been done to the flooring and other areas of the home. The furnace and roof are original at are past or at the end of their useful life.

Neighbor #2, while having the identical house has replaced the HVAC system, the roof and windows as well as updating all the baths and kitchens as well as updgarding and replacing worn flooring.

While both keep there house in excellent shape, neighbor #2’s house will be worth significantly more money. Number #1’s house has much updating to do that could run well over $100k plus while the work is already done on neighbor #2 which has provide numerous updates and improvements.

Amenities

Amenities are items like garages, central air, decks, whirpool baths, patios, sheds, etc…. Appraisers/ Real Estate Agents will make line item adjustments for major amenities that will ultimately effect the final recommended price of your home.

One thing to remember if you have done recent upgrades or additions, like adding a deck or installing central air, you are not going recoup anywhere near the money you probably spent.

Market Conditions Effect How You Determine an Asking Price For Your Home

Current real estate market conditions will certainly have a big effect on how you determine an asking price for your home. Because your using historical data to determine the most probable sales price for your home, it is called a lagging indicator.

You want to pay attention to how quickly properties are going under agreement, the rise or fall in median house prices, what is currently coming on the market etc…

If you are in a red hot sellers market it is probably ok to price your home aggressively a few extra percent won’t hurt you. But catch the market on the downside where median house prices are falling and days on market increasing, not only will you have to price your home spot on your will have to stay ahead of the falling market.

Paying attention to where the current market is headed is critical in determining the final asking price of your home.

Exceptions Can Be Made by Appraisers or Agents

Ideally if appraisers and real estate agents could find 3 identical homes that sold in the past 6 months in the same neighborhood, it would be easy. Unfortunately here in New England its not always that easy.

This is where some subjective decisions need to be made. And, when it comes to appraisals, while there are strict guidelines that are to be adhered to, an exception can always be made as long as a case could be made for them and appropriate pricing adjustments are made. Maybe it is a comparable all the way on the other side of town but in an similar type of neighborhood or you use a cape in the same neighborhood because it is the same neighborhood with a similar function as a comparable sold…..

Here is a common problem I run into in the Tewksbury MA real estate market. There are so few multi family homes sold that often I need to look at other similar communities to come up with comparable sold properties or make serious adjustment to homes that sold way outside the 12 month period.

Emotional Value is Not Market Value

While there can be a quite a bit of subjectivity in pricing your home correctly, there is no subjectivity that comes with emotional value…. its worth nothing.

I get it, little johnny took his first steps, you have your home decorated perfectly to suit your style, many family Christmas’ were had in the living room…. but that creates no value to a buyer looking at your home.

Yet too many sellers try to base their homes price on sentiment and not on historical sales. You are selling a house not the home. The things that make it your home have no value. Make sure you remove the emotion and understand the comparable properties that are presented to you.

Determining the value of your home is mostly about historical sales data.

Final Thoughts On How Do I Determine My Homes Value?

What your neighbor says your home is worth, what Zillow says your home is worth or what you think your home is worth really has no bearing on your homes fair market value.

Your homes value is determined by historical sales data based on comparable properties that meet certain criteria with a little finesse from someone who understand real estate. Take the time to really understand the comparable homes as well as where your current market conditions lie. If any of the agents you interview doe not provide you with historical sales as well as provide you with current market conditions they are probably not the agent for you.

At the end of the day it is your decision on what price to ask for your home. There are three final thoughts to leave you with.

Your homes price is technically good for one day only. While markets change constantly they don’t usually change on a daily basis, but an appraisal or a comparative market analysis your received a year or even 6 months ago are probably no longer valid.

Don’t hyper focus on one particular number. There is a range to fair market value. It is not uncommon for sellers just to here the top number and ignore the low. Unlike a Sony TV that can be purchased any number of places for the same competitively low price, homes are different. Homes are inherently unique and there are no two homes exactly alike.

Lastly, at the end of the day a buyer still needs to step up and pay the price. Ultimately that is what determines what your house is worth. Price it properly and it will lead to getting top dollar and a smooth closing. Overpricing will only lead to frustration and potentially a home that is unsold.

Other Resources on Your Homes Value:

- Paul Sian- Smart Home Features That Can Improve Your Homes Value

- Xavier DeBuck- Why Setting Your Homes Price To High Is A Mistake

- Anita Clark- How Schools Can Impact Your Homes Price

- Luke Skar- Never Buy The Best House In the Neigborhood- Neighboring Homes Effect Its Value

How to Determine Your Home Value is provided by Kevin Vitali of EXIT Group One Real Estate of Tewksbury MA. If you would like to sell your home give me a call at 978-360-0422 and let’s get the process started.

Real Estate Services in the following areas: Northeast Massachusetts, Merrimack Valley, North Shore, and Metrowest. Including the following communities and the surrounding area- Amesbury, Andover, Billerica, Burlington, Chelmsford, Dracut, Groveland, Haverhill, Lowell, Melrose, Merrimac, Methuen, Middleton, North Andover, North Reading, Reading, Stoneham, Tewksbury, Tyngsborough, Wakefield, Wilmington, Westford

So How Do You Determine Your Homes Value

So How Do You Determine Your Homes Value