Today we will discuss the top credit don’ts while buying a house. When you get a pre-approval and you are in the process of buying a home in is important to keep your credit status quo. Your credit score is a complicated thing. It is calculated by “mystical” alogrithyms from the major credit reporting agencies. Something that you think makes sense can send your credit into a tail spin. Alternately some home buyers will just plain do stupid things.

4 Top Credit Don’ts While Buying a Home

- Don’t be late on any payments. Adding any late payments to your credit profile can certainly change your credit score. As far as your credit score is concerned, late payments are a big no-no. The other point to remember is the recency of your late will have an impact on your score.

- Don’t close any credit accounts. After you have had your credit pulled by your mortgage officer do not close any credit accounts thinking your score will improve. Closing a credit account can actually hurt you. Why? If you have limited credit and you close an account it can show you don;t have enough credit. Or, alternately you may have a credit account you have had for a long time that you close. Length of credit is also an important factor that goes into determining your credit score.

- Don’t open new credit accounts. Do not open any new lines of credit. You may be anxious to furnish your home or start work on your home as soon as you move in, but opening a new account can damage your credit score…. even if you leave the balance at zero. What happens is your available credit compared to your income will change even though you have never used the line of credit. This also means buying new cars, boats, etc….

- Don’t significantly increases balances on the credit you have. There are benchmarks the credit scores use on the available credit to balance owed. Balances at 25%, 50% and 75% of your available credit are significant benchmarks. The higher your balance compared to the available credit the more it will effect your credit score.

Takeaway… Don’t alter your credit profile in anyway.

If you feel you should be doing something like significantly paying down debt, closing credit accounts, opening a home depot credit card, etc… don’t do it without running it by your mortgage officer.

Your credit score will affect whether you get financed or not or theloan program for which you are eligible. There are credit scores that are significant turning points for your credit. One major one is 620. 620 is a major milestone in your credit. Say your current credit score is 622 today and you do something that alters your credit by 5 points. This will drop your credit score to 617. At that point you will find that you have been prevented from qualifying for many types mainstream financing. You will have lost the program that worked for you and that dip will make it very difficult to get financed.

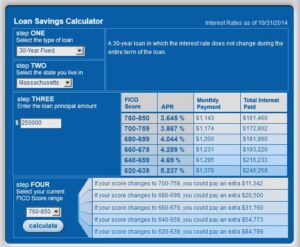

Your credit score will also affect the interest rate you will receive. The higher the credit the better the rate available to you. For some buyers a 1/4 or 1/2 of a point in interest can alter the buying power significantly. MyFico.com has a great loan savings calculator that will show you the impact credit scores may have on your interest rate.

I ran a $250,000 loan scenario. The difference between a 760+ credit score and a 640- credit score was $235 a month. This translates to approximately $42,500 in buying power. Meaning if you had a 760 credit score and would be approved for $250,000, you would only qualify for a $207,500 mortgage. Just a half a percent different in rate translated to about $60 a month difference in mortgage payment.

What Do I Risk If My Credit Score Drops During the Home Buying Process?

- Loss of the ability to get financed completely.

- Loss of a more favorable loan program.

- Loss of a more favorable interest rate.

- Loss of money spend and or escrow deposit. Banks will pull your credit either the day before or the day of funding. If they find your credit score no longer qualifies you, you will have lost your financing. If you lose your financing any deposit monies held in escrow will most likely be forfeited.

The best thing to do is consult your loan officer before making any significant changes to your credit profile.

_____________________________________________________________________

This article, Top Credit Don’ts While Buying a House, was provided of Kevin Vitali of EXIT Group One Real Estate. I have been in the business for many years and can provide you with the experience you need to buy a home…. from making the decision to buy, financing, what to buy, to a closing….. I can help. If you would like to discuss an upcoming purchase please feel free to give me a call at 978-360-0422.