Assessing Your Needs Upfront Can Save you Months of Frustration

When buying a home, assessing your needs upfront can help you maintain your focus. Be careful not to confuse wants with needs. When I say needs I am talking about the base needs that are an absolute must. Deciding to buy your first home or to move from one you already own is a big decision. Take a few moments and assess your needs on paper.

The first question to ask yourself is: Why are you looking to buy a home and what are you hoping to accomplish, short term and intermediate term (remember buy a house that will suit your needs for a minimum of 5-10 years)? Write it down memorialize it.

Below is a list of what I find to be some of the bigger driving factors when purchasing a home. I usually ask buyers to rank the importance between 1 being the most important and 8 being the least important criteria when purchasing a home. Each criteria can only have one rank…. There can’t be two number ones!

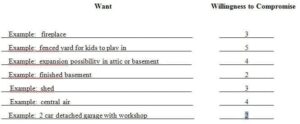

From there I will ask you ten things you think you want in a home and if there is room for compromise. For example a want could be a fireplace or granite in the kitchen or a 1 acre private lot. Then next to it but your level of compromise on that need on 1-5. 1 being very hesitant to compromise and 5 being I can compromise easily.

Assessing Your Needs- Rank the Need

____ The Town- The town or towns you look in may be a huge driving force about where you look for a home. Maybe family lives there or you are entrenched in a community already or any number of reasons

____ The Commute- Commuting time can be important for a lot of buyers not wanting to spend hours on the road everyday and sometimes can be one of the driving forces of where to look for a home.

____ The Location- What type of location would you like with-in a community. For many buyers a neighborhood setting at the end of a cul-de-sac is highly desirable. For others that is not so important and a busier secondary road could buy you the same house for less money then the one at the end of the cul-de-sac.

____ School System- Many home buyers with children want the best schools system that their money can be. Opting ro a much smaller home in a better school system can be a priority for them.

____ Size of Home- The size of your home will often dictate what the basic function of your house will be as far as room count, bedrooms and bath.

____ Age of Home- For some buyers the age is important to them feeling a home that is less than 20 years old may cause less short term problems. There is also a certain style issue for some that can go along with the age of a home.

____ Condition of Home- Are you only willing to look at pristine homes or would you consider a home that requires some cosmetics or even some major renovations?

____ Amenities of Home- There may be certain amenities that you must have in a home. Maybe it’s a detached garage for business purposes, or an in-law apartment a first floor bedroom or again a number of different scenarios can come into effect here. This is one criteria where you should not confuse wants with needs. A first floor bedroom for grandma who can’t climb stairs is a need. A fireplace in the living room is a want.

Assessing Your Wants When Buying a Home

Buying a home is very personal and there can be many different reasons and needs that compel a buyer to buy a home. These may not be the only criteria, but be open with your buyer’s agent about your wants and needs. Feel free to add the absolutely needs to the list and rank in order of priority when assessing your home buying needs.

Tip- When assessing your needs, don’t be afraid to reassess as you get out and look and homes and find out where reality may lie. Reassess with your agent on a regular basis.

I have been helping buyers successfully purchase for many years and I can tell you your wants and needs will change over the process, especially if your are just starting your home search. If you find the right buyer’s agent and they become a trusted advisor, they can quickly help you asses your needs and wants and help translate it into the perfect home for you.

Many times a buyers wants and needs do not meet their budget, and that is certainly alright. You just have to get out there and find out where reality may lie.

A great example I personally run into a lot, is a buyer will call me because they want to be in a certain school system. Which, by me, happens to be Andover. After chatting I find out that the most they can afford is $275,000 is the top of their home buying budget. Today as I write this article there are only 3 houses below $300,000 in Andover all of which are over $275,000. All three of these homes are challenged as far as condition, size and/or location.

Another example is a buyer will approach me wanting to buy a new construction there budget is $450,000. They will give me a list of upscale towns where they would like to live. Through experience and some quick research I can tell them that the chances of finding a new construction in the communities they are interested in is slim to none. What they want or need just does not exist.

Now I am not being a Debbie Downer. In this example each town had 10-12 new construction that sold in the past year. The data speaks for itself. To find a new construction in Andover for 450k will probably be impossible. Tewksbury may happen but the chances are slim. Dracut or Haverhill would be more realistic.

| Average Sale | Lowest Sale | Highest Sale | Average Sq Ft | |

| Andover | $829,000 | $617,000 | $1,190,000 | 3500 |

| Dracut | $472,000 | $340,000 | $558,000 | 2400 |

| Tewksbury | $500,000 | $443,000 | $565,000 | 2500 |

| Haverhill | $414,000 | $414,000 | $483,000 | 2200 |

Tip- Finding out the median house price of a town over the last year will quickly help you determine what your likeliness of success will be in a town given your budget and help match your budget with your assessment of needs and wants.

For example, in both cases: Andover has a median house price of $567,000. That will tell you that you will probably not find a new construction below the median house price and that to find a house that is priced 35-40% below the median or more will be difficult

I cannot tell you how often this happens. Many times buyers are out there floundering getting frustrated because they don’t fully understand the market and they are approaching it haphazardly. I meet up with them and we connect and start to have a real dialogue about their wants and needs. I can then have a discussion backed up with data showing what exists out in the current real estate market place. Remember I do this every day probably 6 days a week 8-10 hours a day. It is my job.

We can now focus on real needs and real homes that will fit your criteria instead of spending months being aggravated and frustrated.

Tip- A good buyers agent can quickly help you assess your needs based upon experience, knowledge and data. They can then help direct you in the right direction.

In The End, Assessing Your Needs Upfront Will Save You Time, Money and Aggravation

Ok so you can see how assessing your needs early on in the process can save you time and aggravation. How can it save you money? Driving around going to showing after showing, open houses or doing drive-bys costs you in gas and wear and tear on your car. Don’t forget time taken off from work. But where it will really cost you money is when you get frustrated and aggravated. When your frustrated and aggravated you will start to make wrong decisions in haste. When your patience is gone you can buy the wrong house, in the wrong community or overpay for a house just to be done with the process.

Again the reasons to buy a home can be so personal. Take 15 minutes to assess your reasons for buying a home, your wants and needs. It will help focus your home search and keep you on track. Lastly, it is perfectly alright to adjust those wants and needs as you get out into the real estate market and start to get an understanding of where reality may lie for you.

_________________________________________________________________

Assessing Your Needs When Buying a Home is provided by Kevin Vitali a Massachusetts Buyers Agent. Kevin has been helping home buyers for many years and can help you to. If you would like a no-obligation buyer consultation call Kevin at 978-360-0422.