The answer isn’t as simple as you might think. The timeframe for closing on a house is influenced by various factors, from your financial situation to the state of the real estate market, the terms of the transaction and more.

In this article, we will look at the home-buying process and provide you with realistic expectations. Buying a house involves multiple steps that can impact the timeline, from submitting an offer to reviewing inspection reports and navigating the mortgage approval process. Understanding these steps and the potential hurdles along the way will help you plan your timeline effectively and optimize the closing process.

Whether you’re a first-time homebuyer or a seasoned investor, this article will equip you with the knowledge you need to navigate the maze of timelines and expedite the closing on your new home. So let’s dive in and unlock the secrets of the closing timeframe!

Jump To A Section....

How Long Does It Take To Find A House?

For practical purposes, the article covers the timeframe from putting a home under agreement to the time the deed is recorded. This part of the process is predictable; most closings take 30-45 days.

But if you are wondering how long it takes from the time you start your search, realize that is highly variable. Many factors include the market, if this is your first home, a move-up home, the time you need to get a grip on the market, your level of commitment, etc…

For a typical first-time home buyer in Massachusetts who has never bought a home looking in an average price range and is committed to buying, it is usually a 4-6 month process. But again, realize many factors are involved, and it can take much longer.

Home sales expert Bill Gassett of Maximum Real Estate Exposure provided helpful guidance for buyers and sellers.

One of the most essential terms in any real estate contract is the closing date. Buyers and sellers negotiate this term quite frequently based on needs and desires. Of course, there are some expected time frames in most sales. You should expect that the closing will be somewhere between 30-60 days from an accepted offer. The beauty of real estate, however, is the fact everything is negotiable. Sometimes closings happen within a couple of weeks if a buyer is paying cash. In other instances the seller might negotiate a longer close date because they haven't located a home they would like to purchase. The bottom line is to keep an open mind. Being flexible could lead to getting an acceptance on other terms more vital to you.

Understanding the Closing Process: How Long Does it Take to Close on a House?

The closing process is the home-buying journey’s final and perhaps most critical phase. It’s the stage where all the legal, financial, and logistical details are finalized, and property ownership is officially transferred from the seller to the buyer.

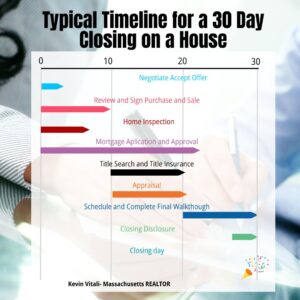

To help you navigate this complex process, let’s break down each step in detail, along with estimated timelines, to give you a clearer picture of what to expect.

1. Accepting An Offer (1-3 Days)

What It Is: Massachusetts is a two-step process. The first step is the contract to purchase, or what many consider the “offer.” It is a simple two-page form spelling out the major details of the transaction.

Timeline: Once you submit an offer, there may be a negotiation period to finalize and reach an agreement. It can take several hours to several days for the buyer and seller to reach an agreement.

2. Review and Signing of the Purchase Agreement (1-3 Days)

What It Is: The purchase agreement is a legally binding contract between you and the seller, expanding on the terms of the sale. This document includes the purchase price, closing date, contingencies (such as inspections or financing), and other agreed-upon conditions.

Timeline: Typically, this step is completed within 1-3 days, depending on the negotiations between the buyer and seller. It’s essential to review the agreement carefully, ideally with the help of a real estate attorney, to ensure all terms are clearly understood and agreed upon.

3. Home Inspection (7-10 Days)

What It Is: A home inspection is a thorough evaluation of the property’s condition performed by a licensed inspector. The inspector will check for structural damage, plumbing or electrical problems, and potential safety hazards.

Timeline: This process usually takes 7-10 days from the time the offer is accepted. Scheduling the inspection promptly is crucial, as it allows you to address any issues or negotiate repairs with the seller before moving forward.

4. Mortgage Application and Approval (21-45 Days)

What It Is: If you’re financing the purchase with a mortgage, this step involves submitting a formal application to your lender. The lender will then process your application, which includes verifying your income, assets, credit history, and the property’s value through an appraisal.

Timeline: The mortgage approval process is often the most time-consuming part of closing, typically taking anywhere from 21 to 45 days. Factors such as the lender’s workload, the complexity of your financial situation, and the results of the property appraisal can all influence this timeline.

5. Title Search and Title Insurance (7-14 Days)

What It Is: A title search is conducted to ensure that the property’s title is clear of any liens, encumbrances, or legal disputes that could affect your ownership. Title insurance is then purchased to protect you and the lender against any future claims on the property.

Timeline: This step usually takes 7-14 days. The title company or your attorney will handle the search and ensure that any issues are resolved before closing. In some cases, complex title histories can extend this timeline.

6. Appraisal (7-10 Days)

What It Is: An appraisal is an independent assessment of the property’s market value, conducted by a licensed appraiser. The lender requires this to ensure that the loan amount does not exceed the property’s value.

Timeline: The appraisal typically takes 7-10 days to complete. If the appraised value comes in lower than the agreed-upon purchase price, this could lead to renegotiations or even delays in the closing process.

7. Final Walkthrough (1-2 Days Before Closing)

What It Is: The final walkthrough is your last chance to inspect the property before closing. This step ensures that the property’s condition hasn’t changed since the inspection and that any agreed-upon repairs have been completed.

Timeline: The final walkthrough is generally scheduled 1-2 days before the closing date. It’s a quick but crucial step to ensure there are no surprises on the day of closing.

8. Closing Disclosure (3 Days Before Closing)

What It Is: The Closing Disclosure is a detailed document provided by your lender, outlining the final terms of your loan, including the interest rate, monthly payments, and closing costs. You’ll receive this document at least three business days before closing.

Timeline: You’re legally required to receive the Closing Disclosure three days before closing, giving you time to review the terms and ensure everything is correct.

9. Final Closing Meeting (1 Day)

What It Is: The closing meeting is the final step where all parties—buyer, seller, real estate agents, attorneys, and sometimes the lender—gather to sign the necessary documents. Once everything is signed and the funds are transferred, you’ll receive the keys to your new home.

Timeline: The final closing meeting typically takes place on the scheduled closing date and can last anywhere from an hour to a few hours, depending on the complexity of the transaction.

The entire closing process can take anywhere from 30 to 60 days, depending on various factors such as the type of financing, the responsiveness of the involved parties, and the complexity of the property’s title. By understanding each step in detail and planning accordingly, you can help ensure a smooth and efficient closing experience, bringing you one step closer to unlocking the doors to your new home.

Factors that Influence the Timeframe to Close on a House

The timeframe to close a house can vary significantly, depending on various factors.

One of the most significant factors is the financing the buyer is using. For example, a cash buyer may be able to close much more quickly than a buyer who is obtaining a mortgage, as the mortgage approval process can take several weeks.

The complexity of the property itself and the transaction can also impact the closing timeline. For instance, a property with a complex title history or requiring extensive inspections and repairs may take longer to close than a straightforward, well-maintained property.

Additionally, the property’s location can play a role, as different states and municipalities may have their own unique closing requirements and timelines.

Finally, the responsiveness and efficiency of the various professionals involved in the closing process, such as the real estate agent, the lender, the title company, and the attorney, can also impact the overall timeline. Buyers and sellers who work with experienced and responsive REALTORS may be able to expedite the closing process more effectively.

The Role of the Buyer in Expediting How Long it Takes to Close on a House

There are several steps you can take to help expedite the closing process and ensure a smooth and efficient transaction. One of the most important things you can do is to get pre-approved for a mortgage before you even start your home search. This demonstrates to sellers that you are a serious and qualified buyer and streamlines the mortgage approval process once you have an accepted offer.

Another key step is to proactively provide all the necessary documentation and information to your lender, real estate agent, and other professionals involved in the closing process. This includes things like bank statements, tax returns, employment information, and any other documents that may be required. Being organized and responsive can help reduce delays and keep the process moving forward.

Additionally, it’s important to be flexible and responsive during the inspection and appraisal process. This means being available to schedule inspections and walkthroughs and being willing to address any identified issues promptly. Buyers who are proactive and cooperative during these process stages can help ensure a smoother and more efficient closing.

Finally, buyers must stay in close communication with their real estate agent, REALTOR, and lender throughout the closing process. By staying informed and up-to-date on the transaction’s status, buyers can help identify and address any potential roadblocks or delays before they become major issues.

The Role of the Seller in How Long it Takes to Close on a House

While the buyer plays a significant role in expediting the closing process, the seller also has an important part to play. One of the most critical things a seller can do is to ensure that all the necessary paperwork and documentation is in order and readily available.

This includes things like the deed, the title insurance policy, and any relevant disclosures or warranties.

Sellers should also be responsive and cooperative during inspection and appraisal. This means being available for walkthroughs, addressing any identified issues, and providing any necessary information or documentation to the buyer’s team.

Sellers can also help expedite the closing process by being flexible and accommodating when scheduling the final closing meeting. By being willing to work around the buyer’s schedule and any last-minute changes, sellers can help ensure that the transaction is completed as quickly and efficiently as possible. Finally, sellers should proactively communicate with their real estate agent and the buyer’s team throughout the closing process.

By staying informed and addressing any issues or concerns as they arise, sellers can help minimize delays and keep the transaction on track.

Common Delays in the Closing Process and How to Avoid Them

Despite the best efforts of both buyers and sellers, several common delays can arise during the closing process.

One of the most common is delays in the mortgage approval process. This can be caused by various factors, including issues with the buyer’s credit, income, or employment history or delays in the lender’s underwriting process.

Another common source of delays is issues with the property title or the title insurance process. This can include things like liens, encumbrances, or other title-related issues that need to be resolved before the closing can be completed.

Delays can also arise during the inspection and appraisal process, particularly if significant issues are identified that need to be addressed. In some cases, the buyer and seller may need to negotiate over who is responsible for addressing these issues, which can slow down the closing process.

Finally, delays can also occur due to issues with the closing documents or the final closing meeting itself. This can include things like scheduling conflicts, last-minute changes, or issues with the paperwork. To avoid these common delays, it’s important for both buyers and sellers to be proactive and stay on top of the closing process. This means being responsive to requests for information, addressing any issues or concerns as they arise, and working closely with their real estate agent and other professionals involved in the transaction.

It can’t be stressed enough that by being organized, communicative, and flexible, buyers and sellers can help ensure a smooth and efficient closing process and avoid issues that can delay a closing.

Tips for a Smooth and Efficient Closing Process: How to Minimize How Long it Takes to Close on a House

In addition to the steps that buyers and sellers can take to expedite the closing process, there are also several tips and strategies that can help ensure a smooth and efficient closing experience.

One of the most important is to work with experienced and reputable professionals, such as real estate agents, lenders, title companies, and attorneys. These professionals can provide valuable guidance and support throughout the closing process, helping to identify and address any potential issues or roadblocks before they become major problems.

They can also help ensure that all the necessary paperwork and documentation is in order and that the closing meeting is well-organized and efficient. Another important tip is to stay organized and keep detailed records throughout the closing process. This includes keeping track of all the important documents and paperwork and any key deadlines or milestones.

By staying organized, buyers and sellers can help ensure that nothing falls through the cracks and that the closing process stays on track. It’s also important to communicate proactively with all the parties involved in the closing process, including the real estate agent, the lender, the title company, and the attorney.

By staying in regular communication and providing updates on the transaction’s status, buyers and sellers can help identify and address any issues or concerns before they become major problems. Finally, it’s important to be flexible and adaptable throughout the closing process. Unexpected delays or issues can arise at any time, and being able to adjust and respond to these challenges can make a big difference in the overall success of the transaction.

How Long It Takes To Close On A Home: The Average Timeframe

The average timeframe to close on a house can vary significantly depending on a number of factors, including the type of financing the buyer is using, the state of the real estate market, the complexity of the property, and the responsiveness and efficiency of the professionals involved in the closing process.

In general, cash buyers tend to have the fastest closing times, often being able to close in as little as 2-3 weeks. This is because they don’t have to go through the mortgage approval process, which can be one of the closing process’s most time-consuming and complex aspects.

Buyers who are obtaining a mortgage, on the other hand, can expect a longer closing timeline, typically ranging from 30-60 days. This is because the mortgage approval process can take several weeks, and several additional steps are involved, such as the home appraisal and the title review.

Finally, the complexity of the property itself can impact the closing timeline. For instance, a property with a complex title history or one that requires extensive inspections and repairs may take longer to close than a straightforward, well-maintained property.

Additionally, the property’s location can play a role, as different states and municipalities may have their own unique closing requirements and timelines. By understanding the average timeframe to close on a house in different situations, buyers and sellers can better plan and prepare for the home-buying process and work to ensure a smooth and efficient closing experience.

Resources and Tools to Help Speed Up How Long it Takes to Close on a Home

In addition to the strategies and tips outlined above, there are also a number of resources and tools that can help buyers and sellers expedite the closing process. One of the most important is working with an experienced and reputable real estate agent with a track record of efficiently navigating the closing process.

Real estate agents can provide valuable guidance and support throughout the closing process, helping to identify and address any potential issues or roadblocks before they become major problems. They can also help coordinate the various professionals involved in the transaction, ensuring that all the necessary paperwork and documentation is in order and that the closing meeting itself is well-organized and efficient.

Another valuable resource is online tools and platforms that can help streamline the closing process. For example, some lenders and title companies offer digital platforms that allow buyers and sellers to upload and share documents, track the status of the transaction, and even schedule the final closing meeting.

Additionally, there are a number of online resources and guides that can provide valuable information and advice on navigating the closing process. These can include articles, blog posts, and even video tutorials that cover everything from the mortgage approval process to the final closing meeting.

By taking advantage of these resources and tools, buyers and sellers can help ensure a smoother and more efficient closing process, and ultimately achieve a successful and stress-free home purchase or sale.

FAQs

How long does it take to close on a home?

What factors go into how long it take to close on a house?

What is the most critical step of closing on a home?

Could I cash offer speed up a closing?

What is the longest part of the closing process?

What is a common reason a closing is delayed?

Conclusion: Planning for a Successful Home Purchase and Understanding How Long it Takes to Close on a House

Buying a home is a significant investment and a major life event, and the closing process is a critical part of that journey. By understanding the various factors that can influence the timeframe to close on a house, and the steps that buyers and sellers can take to expedite the process, you can better plan and prepare for a successful home purchase and closing experience.

Whether you’re a first-time homebuyer or a seasoned real estate investor, the key is to stay organized, communicate effectively, and work closely with experienced professionals who can guide you through the process.

By following the tips and strategies outlined in this article, you can help ensure a smooth and efficient closing, and move into your new home with confidence and excitement. Remember, the closing process is just one part of the larger home-buying journey, and it’s important to approach it with a clear plan and a positive mindset. By staying focused, adaptable, and proactive, you can navigate the closing process with ease and achieve your ultimate goal of becoming a homeowner.

So, whether you’re just starting your home search or are already in the midst of the closing process, take the time to understand the timeline, identify any potential roadblocks, and work with your team to ensure a successful and stress-free closing. With the right approach and the right resources, you can unlock the doors to your dream home and start a new chapter in your life.

Author Bio

Kevin Vitali is a Massachusetts REALTOR out of Haverhill MA that serves Essex County and Northern Middlesex County in Massachusetts. If you want to buy or sell a home, let me use my years of experience to get you the best possible outcome.

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com