Most home buyers need a mortgage to buy a home. Getting a mortgage can be quite a daunting task. You will have a whole set of mortgage terms being thrown around. One of which is the debt to income ratio.

So you may be left wondering what is debt to income ratio.

The acronym for debt to income ratio is DTI. Lenders and real estate agents will throw that acronym around like everyone knows what it is but if you never have applied for a mortgage before you may not know what it is.

Your debt-to-income ratio is one qualifying factor in how much house you can afford and your ability to get approved for a home loan.

What Is Debt To Income Ratio?

Your DTI or debt to income ratio is calculated by dividing your monthly debt payments by your total monthly income. Your ratio is used by lenders to evaluate your capability to make your monthly mortgage payment for the amount of money you are borrowing to purchase a home.

How Is Debt To Income Ratio Calculated?

Your debt-to-income ratio is calculated by adding up your monthly consumer debt and dividing it by your gross income (income before taxes).

When we talk about monthly expenses in the context of a mortgage we are talking about:

- Rent or Mortgage Payments/ Housing Expense

- Car Payments- Includes leases as well.

- Student Loans

- Alimony or Child Support if it is court mandated

- Minimum Payment On All Credit Cards

- Minimum Payment on Lines of Credit

Do not include groceries, utilities or other expenses when calculating your debt-to-income ratio. They are expenses and not debt.

Now you add up all of your monthly debt and divide the total by your income to get a percentage. That percentage is the amount of consumer debt that consumes of your monthly income.

For example:

Consumer Debt/ Housing Expenses = $3300

Your Gross Income = $7800 dollars

3300 / 7800 = Total Debt to Income Ratio of 42%

Debt To Income Ratio Calculator

[CP_CALCULATED_FIELDS id=”6″]

How Does Debt To Income Ratio Affect Your Mortgage?

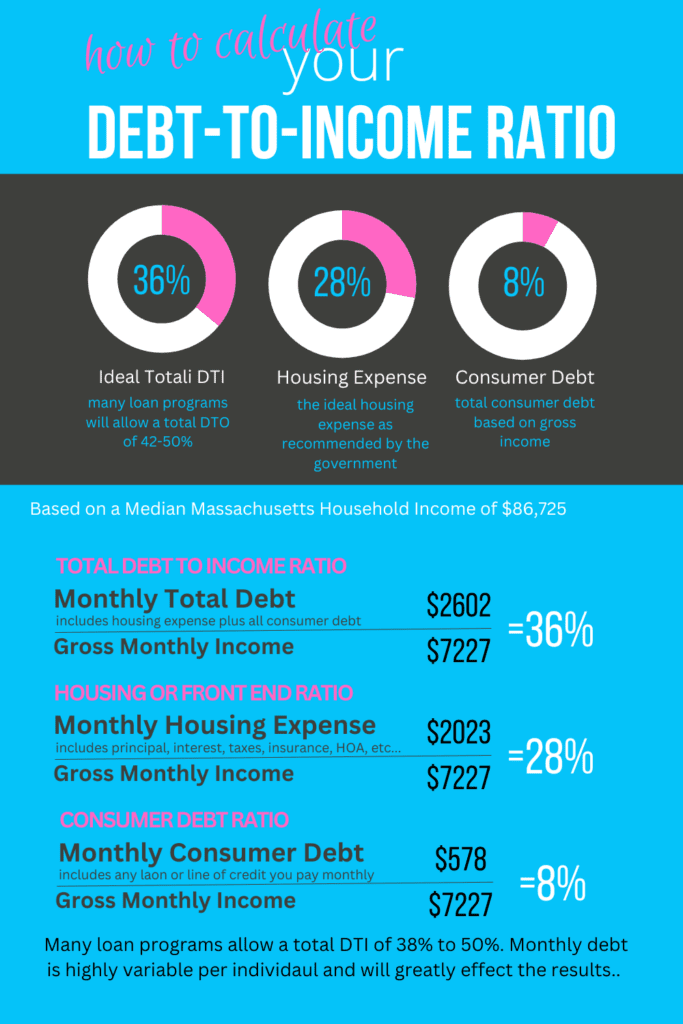

Most loan programs allow a debt to income ratio of 38-43%. Some loan programs will even go as high as 45-50%. This is how a bank determines how much of a house a buyer can afford and your ability to make your monthly loan payments.

Take the scenario above. A buyer makes $750 in car payments, student loans and minimum payments on credit cards. Leaving $2550 a month to go to their monthly housing expense.

The housing expense will include:

- Principal and Interest Payment

- Monthly Tax Payment Into An Escrow Account

- Monthly Insurance Payment Into An Escrow Account

- Private Mortgage Insurance

- HOA or Condo Fees

Let’s estimate that the buyer is buying a single-family home and is putting 10% down leaving them with a PMI payment. We will use the following assumptions:

Taxes are $380 a month

PMI is $200 a month

Insurance is $110 a month

That leaves about $1710 left to go towards Principal and Interest on a mortgage.

Income is calculated at $7800 per month or $93,600 a year.

At a maximum DTI of 43% and an interest rate of 5.875% the price of a home they buy could not exceed about $375,000 for the purchase price of a home.

Different programs have different DTI requirements. Some can go as high as 50% others below 40% but most loan programs will go up to 43%. Note that their are many variable that factor into your DTI.

Breakdown of DTI

In years past the banks would break debt to earnings ratio down into two factions.

Front-End Ratio- Your front-end ratio is your housing expense alone. Principal and Interest, Taxes, Insurance and Condo Fees are your housing expense. In the previous example, your front-end ratio would be 31%.

Back-End Ratio- Your back-end ratio is your housing expense plus your consumer debt, which we calculated as 42% in the scenario above.

While today’s lenders still break down debt to earnings ratio into front-end and back-end ratios, most do not differentiate between the two.

What Does DTI Tell The Bank and You?

Your ratio shows the lender how your ability to make your monthly payments based on your current debt load and income While 43% to 50% is the maximum a bank will allow for a debt-to-income ratio, it is a guideline.

When it is all said and done, your debt to earnings ratio shows how much house the bank thinks you can afford based on your income and expenses as well as factoring in your credit score.

As for you, the lower your DTI, the more available funds you will have at the end of the month to go to long term savings, need purchases, home maintenance in more….

Your credit score will affect the maximum ratio a bank will consider for a loan program. A higher credit score may allow for a higher DTI, while a lower credit score will lower the maximum DTI for a loan program.

What Is A Healthy Debt To Income Ratio?

Consensus on what healthy ratios are a 28% front-end ratio and a 36% total debt-to-income ratio.

While many loan programs will allow for a mortgage preapproval with higher ratios, general consensus is the 28/36 rule allow a borrower to easily cover their obligations and be able to save money.

You Need To Do What’s Right For You

You can probably get qualified for a higher home loan than you think. Just because the bank approves you for a higher loan amount does not mean that you are comfortable with the payments on your maximum loan approval.

Do what is right for you and your family’s household budget. You are the one who has to cover the mortgage at the end of the month. A balance will need to be met that you can live with.

How To Lower Your Debt To Income Ratio When Buying A House

Your DTI can be lowered. There certainly are many variables that can affect your total ratio.

- Purchase a less expensive home. Think about what you really need versus what you really want. A less expensive home than you were first counting on can impact your ratios.

- Increase your income. Easier said than down but increasing your income will lower your ratios.

- Raise your credit score. Raising your credit score could lower your interest rate. With all other variables remaining the same a lower interest rate will lower your DTI.

- Lower your interest rate. Shop loan programs with lower interest rates or consider paying points upfront to lower your home loan interest rate.

- Lower Your Monthly Consumer Debt Payments. Paying down or eliminating debt can go a long way in lowering your DTI.

- Increase your downpayment. See what an extra $10,000 or $20,000 dollars will do for your ratio.

The lower your total ratio is the more money you will have in your pocket at the end of the month for living expenses and savings.

Summary

Going into the home-buying process it is important to have an understanding of what goes into getting a mortgage.

Having an understanding as you start to think of buying a home, will allow you to affect your Debt to Income Ratio in a positive way. You also can calculate how much home you can afford as you start the process.

Unfortunately, the affordability of buying a home, especially your first one is high. Anything you can do to put more money in your pocket at the end of the month will only benefit you.

Other Massachusetts Real Estate Resources:

- Many home buyers start the home-buying process well before they are ready to buy a home. A great way to get a handle on what houses have to offer in a certain price range in a particular community is by attending open houses. Bill Gassett provides some insight into finding local open houses.

- We have all heard the old adage that kitchens sell homes. And, for the most part, it is a true statement. Karen Highlands provides 2023 kitchen design trends that will appear to today’s buyers.

- Some markets in the US are still overheated….. multiple offers, homes going well over asking, buyers giving up contingencies and more. As prices go significantly past asking there is a chance that the home might not appraise. Paul Sian gives us some great insight into using an appraisal gap clause in a contract.

What Is Debt To Income Ratio When Apply for a Home Loan? is provided by Kevin Vitali, your local Massachusetts REALTOR. Thinking of buying a home? Call me for your free home consultation and lets get you started on a new home. 978-360-0422