Previously I have written an article about solar panels, Selling Your Home with Solar Panels. Before signing a lease and installing solar panels or having a lease agreement transferred to your name, there are a few things to consider. One point that was brought up in this article, is that most companies will file a lien or an encumbrance against your home. Register John O’Brien, from the Southern Essex Registry of Deeds has issued a UCC Solar Panel advisory.

Check out this article from Channel 7 News, Hank Investigates Leased Solar Panels. The investigation does go into the fact that homeowners are signing the leases not fully understanding what is being signed.

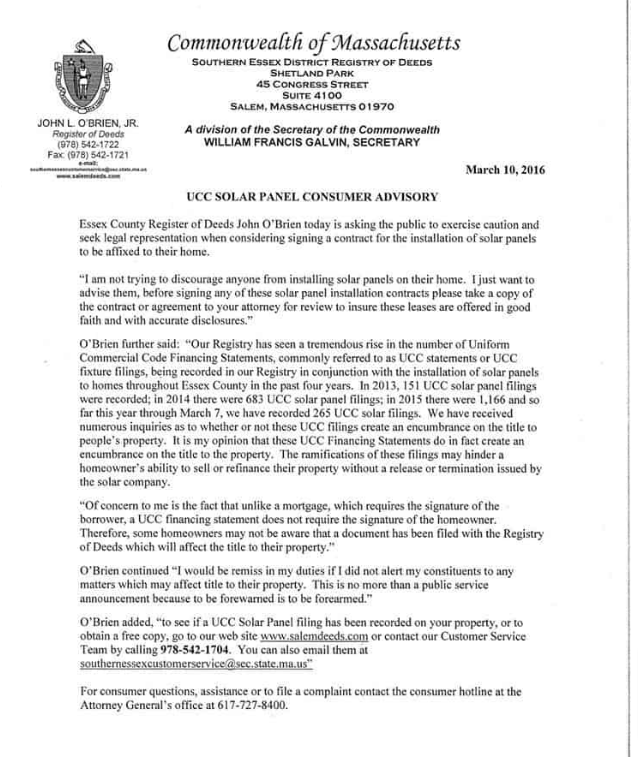

UCC Solar Panel Advisory issued by Register John O’Brien

Register John O’Brien, in the UCC Solar Panel Advisory, is not stating whether leased solar panels are a good or bad idea. His recommendation is to have an attorney review the document that you sign. In most cases, you will have an encumbrance filed on your home. Essentially you are bringing in another party who may have some say on your home. In its simplest terms, an encumbrance is a burden or impediment. In legal terms it is a mortgage or other charge on property or assets.

Most solar companies will file a UCC-1 against your home. Some solar companies claim this is not a lien. Here is Wikipedia’s definition of a UCC-1:

“A UCC-1 financing statement (an abbreviation for Uniform Commercial Code-1) is a legal form that a creditor files to give notice that it has or may have an interest in the personal property of a debtor.”

What Does Attorney Rick Carter Have to say about the UCC Solar Panel Advisory?

So today I decided to contact Rick Carter of Carter Law. His view was a UCC-1 is a lien against the property. Rick pointed out that if you refinance the UCC-1 has to be removed to secure a refinance loan or HELOC. Attorney Carter also pointed out that depending upon the terms of your particular lease that upon the sale of a home the UCC statement needs to be either removed by having the new buyer approved to assume the solar panel lease or if that fails then the seller may possibly have to pay off the remaining lease payments.

Currently, you cannot secure a reverse mortgage or an FHA loan on a home that has leased solar panels. However, there are recent conversations to change these FHA guidelines. Before signing up for these leases you will want to see what FHA’s current stance is on loaning on properties with solar panel leases. FHA financing is a popular choice among many home buyers and if there is a possibility that your buyer is limited in buying the property due to FHA guidelines you may be excluding a huge pool of potential buyers.

Are solar panels a good idea or not? I am not going to say yes or no, that is a very individual decision every homeowner must make. If you are considering leased solar panels, run the contract by an attorney so you have a full understanding of how the lease agreement can hinder a sale or refinance of the property. Finally, outside of the lien issue, there are other considerations and you should check out Selling Your Home with Solar Panels. One consideration the article discusses is that home buyers have not completely embraced solar panels and you may drive certain buyers away.

My individual take is if you want leased solar panels and you are planning to stay in your home for a very long time without refinancing or selling, leased solar panels could save you money. If this is a short-term or intermediate-term home for you slow down and take everything into consideration.

________________________________________________________________

This article, UCC Solar Panel Advisory, was written by Kevin Vitali of EXIT Group One Real Estate. Thinking of buying or selling a home, call me at 978-360-0422 or email me at kevin@kevinvitali.com