You decide to buy a home and want to get the lowest mortgage rate. Of course, who wouldn’t! But things may not always be what they appear to be.

You decide to buy a home and want to get the lowest mortgage rate. Of course, who wouldn’t! But things may not always be what they appear to be.

If you are looking online at mortgage rates or in the paper, read the fine print. Of course they advertise the lowest mortgage rate they can offer, but there is usually a slew of conditions.

Here is a list of criteria that can prevent you from getting the lowest mortgage rate advertised:

- Is it a refinance or a purchase? A purchase rate will be lower than a refinance rate.

- What type of property is it? Anything other than a single family will have a higher interest rate.

- How much money are you putting down? Most teaser rates are assuming you have 25% equity in the property. For less equity there are interest rate bumps.

- What is your credit score? There are interest rate hits for about every 20 points in credit score. With all things being equal a borrower with a 740 credit score will get a much better rate than a borrower with a 640 credit score.

- Is the rate for a 30 year fixed? Sometimes a 5 year ARM, or a 15 year fixed will be used to advertise a rate.

- You could be paying points. Paying a point is buying down the interest rate.

- It is for the shortest rate lock available. The longer your rate lock the higher your interest rate. Teaser rates are usually offering very low rate lock periods.

The list goes on. You get the point. Today I typed in mortgage rates and Quicken Loans came up. There lowest rate was 2.75%

But, read the fine print. This is the criteria that would be used to get the lowest mortgage rate available. It is there but the information is in small print at the bottom and then you have to click to another page. To get this rate is a pretty tall order for most home buyers.

- Mortgage rates could change daily.

- Actual payments will vary based on your individual situation and current rates.

- Some products may not be available in all states.

- Some jumbo products may not be available to first time home buyers.

- Lending services may not be available in all areas.

- Some restrictions may apply.

- Based on the purchase/refinance of a primary residence with no cash out at closing.

- Based on a 15 year loan

- We assumed (unless otherwise noted) that: closing costs are paid out of pocket; this is your primary residence and is a single family home; debt-to-income ratio is less than 30%; and credit score is over 740; and an escrow account for the payment of taxes and insurance.

- The lock period for your rate is 40 days.

- The loan to value (LTV) ratio is 75%. If LTV > 80%, PMI will be added to your monthly mortgage payment, with the exception of Military/VA loans. Military/VA loans do not require PMI.

- Please remember that we don’t have all your information. Therefore, the rate and payment results you see from this calculator may not reflect your actual situation. Quicken Loans offers a wide variety of loan options. You may still qualify for a loan even if your situation doesn’t match our assumptions. To get more accurate and personalized results, please call to talk to one of our mortgage experts.

If your in the middle of closing on a home and all of a sudden you go on the internet shopping interest rates, because you want to get the lowest mortgage rate possible, make sure you are comparing apples to apples.

When you call someone up blindly, of course they are going to quote you the lowest mortgage rate they can. There are many companies who advertise low mortgage rates to reel you in, then as you go along the mortgage process the rate creeps up…. You hear explanations of why your interest rate keeps climbing…. your credit score isn’t perfect, your only putting 5% down, its a condominium, your DTI is too high, etc….

Remember, no one can quote you an exact mortgage rate with out having a full mortgage application, all of your supporting documents, all of the property information and an accurate rate lock. Get pre-approved for a home purchase before looking at homes as well as getting an loan application started.

Getting the Lowest Mortgage Rate in Massachusetts

You are going to find that mortgage rates are fairly competitive between lenders. When comparing rates make sure you are comparing the same scenarios and product. Shop rate on the same day. There are days where mortgage rates fluctuate wildly from day to day.

Instead of shopping just for the lowest mortgage rate, shop for the lender who will give you the best service. One who is responsive, provides good information and explains things in a manner you can understand. It doesn’t do any good to have a low interest rate if your lender can’t perform. Go with a local lender with a local office. If necessary you can drop off documents and meet to go over the loan details.

If you truly want to get the lowest mortgage rate possible, get your financial house in order. Your credit score can drastically effect your mortgage interest rate. Work on getting that score up!

Also, putting more money down and/or paying points will lower your interest rate as well as reduce or eliminate your monthly private mortgage insurance.

Lastly, consider go with a shorter term mortgage like a 20 or 15 year term.

What Does A Massachusetts Lender Advise to Get the Lowest Mortgage Rate in Massachusetts

I spoke to Cory Parker of AnnieMac Home Mortgage and his advice for seeking the lowest mortgage rate possible is three fold and reiterates some of the points I already made.

First ensure your credit lines are paid to date, on time and has been for the prior 12 months.

Secondly, make sure you have the minimum down payment of no less than 3% for a government home buying program. A larger down payment will help get you the lowest interest rate.

Finally, Cory recommends to make sure you are in good standing employment wise with at least a solid 24 month work history.

These three things will allow a home buyer to present themselves at the lowest possible financial risk and thus the best possible interest rate.

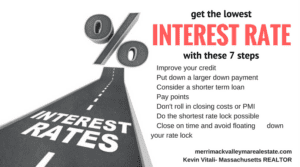

My last word of advice, once you are in escrow on your new house, stop looking at the teaser interest rates online. It will just drive you crazy. Lets recap what are some things you can do to get the best rate possible?

- Improve your credit

- Put down a larger down payment

- Consider a shorter term loan

- Pay points

- Don’t roll in closing costs or PMI

- Do the shortest rate lock possible

- Close on time and avoid floating down your rate lock

Thank you to Cory Parker of AnnieMac Mortgage for weighing in on the topic. Cory can be reached at 860-874-3538 or he can be emailed at cparker@annie-mac.com.

Other Mortgage Resources:

- Bill Gassett- Tip On How to Get the Best Mortgage Rate

- Kyle Hiscock- How To Get the Best Rate On Your Mortgage

- CNBC- How to Shop for The Best Interest Rate

________________________________________________________________

This article, Trying to get the Lowest Mortgage Rate in Massachusetts, was provided by Kevin Vitali, your Massachusetts Buyers Agent.

If you are thinking of buying a home contact me for your buyer’s consultation. I can help you make the most of your next home purchase. Call me at 978-360-0422