Knowing and estimating your tax stamp is essential to calculating your net after all your home-selling expenses and ensuring you have enough money from your proceeds to cover your tax liability.

The transfer tax is just one of the fees that are due upon the sale of your home. Plan accordingly so you have the funds to pay the mandatory tax stamp and any other fees associated with selling a home in Massachusetts.

The transfer tax is just one of several financial obligations that sellers must prepare for. Ask your Massachusetts REALTOR about other potential costs when selling your home. Additional costs could include:

- Real estate agent commissions – Typically ranging from 4% to 6% of the sale price.

- Closing Costs – Included are any costs incurred during the sale including mortgage payoffs, wiring fees, deed preperation, etc…

- Attorney fees – Legal representation is highly recommended to ensure a smooth transaction.

- Outstanding liens or assessments – Any unpaid property taxes or HOA fees must be settled before closing.

- Repairs or concessions – Buyers may negotiate repairs or seller concessions based on the home inspection.

Jump To A Section....

What is the Massachusetts Transfer Tax?

The Massachusetts Transfer Tax or Tax Stamp is a fee imposed when real estate ownership changes hands. It’s calculated based on the property’s sale price and is typically required to record the transaction legally.

This tax is a revenue source for state and municipal programs, including infrastructure and public services.

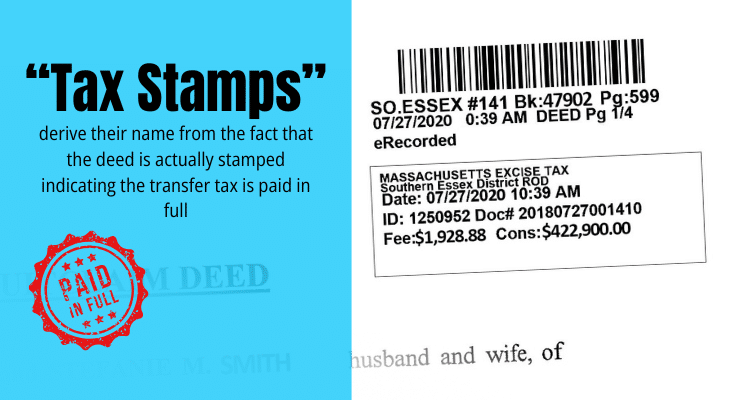

Why Is It Commonly Know As A Tax Stamp?

The term “tax stamp” originates from the historical practice of physically affixing adhesive stamps to documents to signify that a tax had been paid. In the case of the Massachusetts transfer tax, the tax stamp represents the payment of the required fee for transferring property ownership.

While the process has moved mainly to electronic records in modern times, the name persists as a nod to its origins. The physical or digital stamp proves that the transfer tax obligation has been met, ensuring the transaction is legally recognized and compliant with state regulations.

The historical terminology, tax stamp, still may be used but deed excise tax or transfer tax are more modern versions.

Is the Massachusetts Tax Stamp Mandatory Upon the Sale of a Home?

Yes, the Massachusetts tax stamp is mandatory for all property sales in the state. Without the tax stamp, the transaction is incomplete, and the new owner cannot establish legal ownership of the property.

Whether you’re selling a residential home or a commercial building, this step is non-negotiable. The tax stamp proves compliance with state laws and protects all parties involved.

Ensuring the tax stamp is obtained and correctly affixed is often handled during the closing process, typically by the closing attorney or title company.

Calculating the Transfer Tax

For example the tax due on a $672,250 purchase would be $3066.60:

- Sale Price: $672,250

- Rounded Up To The Nearest $500: $672,500

- Multiply By: .456%

- Total Tax: $3066.60

How to Calculate the Real Estate Transfer Tax in Massachusetts

Calculating the deed transfer tax Massachusetts is straightforward but requires attention to detail. The formula is:

Transfer Tax = (Sale Price ÷ Unit Value) × Tax Rate

Detailed Example

Suppose you sell a property in Haverhill MA for $600,000. Using the standard tax rate of $2.28 per $500:

- Divide the sale price by $500: $600,000 ÷ $500 = 1,200 units

- Multiply by the tax rate: 1,200 × $2.28 = $2,736

The transfer tax for this property would be $2,736. However, additional fees may apply if the municipality has supplementary taxes.

Factors Impacting Transfer Tax

- Municipality Surcharges: Some cities, such as Boston, may impose additional fees.

- Transaction Type: Transfers between family members may be exempt or reduced.

- Exemptions: Certain transfers, like gifts or inheritances, might not require full tax payments.

Who Pays the Massachusetts Transfer Tax?

Traditionally, the home seller pays the Massachusetts home tax stamps, but this isn’t set in stone.

Though rare, buyers and sellers can negotiate the responsibility in the purchase agreement. For instance, in competitive markets, buyers may offer to cover the tax to sweeten their offer.

Exemptions to the Massachusetts Transfer Tax

Not every transaction incurs the transfer tax in Massachusetts. Here are common exemptions:

- Family Transfers: Transfers between spouses or direct family members are usually exempt.

- Government Transactions: Properties sold to or by government entities are often tax-free.

- Charitable Organizations: Transfers involving non-profits or charitable entities may qualify for exemptions.

- Inheritance: If a property is inherited, the transfer tax may not apply, depending on the circumstances.

Important Note on Documentation

To claim an exemption, you must file the appropriate forms and provide supporting documentation, such as proof of relationship or charitable status.

Massachusetts Transfer Tax FAQs

- What is the standard rate for the Massachusetts transfer tax?

The rate is typically $2.28 per $500 of the property’s sale price, but some municipalities may add surcharges.

- Are there exemptions for first-time homebuyers?

While Massachusetts doesn’t offer specific transfer tax exemptions for first-time buyers, other state programs may provide assistance.

- What happens if the transfer tax isn’t paid?

Failure to pay the transfer tax prevents the deed from being recorded, effectively stalling the sale. Penalties may also apply.

- Can the transfer tax be included in closing costs?

Yes, it’s often listed as part of the closing costs, along with other fees like attorney charges and title insurance.

- Is the transfer tax deductible on federal taxes?

No, the transfer tax isn’t deductible. However, it can be added to the cost basis of the property for capital gains calculations.

- How can I find out if my municipality charges additional taxes?

Contact your local tax assessor’s office or consult with a real estate attorney to confirm any additional fees.

Don’t Forget To Consider Other Closing Costs

When budgeting for the Massachusetts transfer tax, it’s essential to remember that it’s just one piece of the puzzle. There will be additional closing costs when you sell your home. These fees could include a real estate commission, attorney fees, wiring pay-offs, title searches, and recording of any mortgage discharges.

By accounting for these additional expenses upfront, you will avoid surprises at the closing table and ensure your financial plan stays on track. Reviewing your closing cost estimate closely with your real estate agent or attorney is always a good idea to ensure all bases are covered. A little preparation goes a long way toward a smooth closing process!

Conclusion

The Massachusetts transfer tax is essential for anyone buying or selling property in the state. This guide provides clear guidelines for calculations, exemptions, and documentation, equipping you to handle the process with confidence.

Whether navigating transfer stamp requirements in Massachusetts or estimating the property deed tax, staying informed ensures a smoother transaction. For personalized advice, consult with a real estate or tax professional.

Author Bio

Kevin Vitali is a Massachusetts REALTOR out of Haverhill MA that serves Essex County and Northern Middlesex County in Massachusetts. If you want to buy or sell a home, let me use my years of experience to get you the best possible outcome.

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com