Home » Kevin Vitali Massachusetts REALTORS-Real Estate Blog » Mortgage » The Ultimate Guide to Understanding Your Credit Score

The Ultimate Guide to Understanding Your Credit Score

Credit scores play a large role anytime you buy something over time, like a home or automobile. Not only does your credit score play a role in qualifying for a home mortgage it is also effects your interest rate. The lower your credit score the higher your interest rate and vice versa. I will cover some credit score basics in this article which will help in you in understanding your credit score.

I will discuss your score as it relates to getting a home mortgage. Realize there are different types of credit scores and how they are reported for different types of lines of credit. Immediately pull your credit report the minute you think you will buy a house. You can either do it yourself or have your mortgage officer pull your credit when getting a pre-approval letter.

Understanding Your Credit Score

Effects of Your Credit Score

As mentioned in the opening paragraph your credit score will affect your ability to obtain credit. It will also determine your interest rate for that line of credit. Whether it is a credit card, home loan, automobile loan…. it doesn’t matter. You are all probably aware of that.

But, did you know that your credit score can affect other things as well?

- Insurance Rates- The rate you are quoted on your home insurance and car insurance will be affected by your credit score.

- Private Mortgage Insurance- If you are putting less than 20% down on a home the bank will require you to carry private mortgage insurance or PMI. The amount you pay for PMI will be affected by your credit score.

- Housing Rental- When renting an apartment or home your credit will most likely play a large role in having your application accepted.

- Employment- There are some jobs in the financial fields that may be dependent on your credit score.

As you can see, your credit score can affect many areas of your life. Over a lifetime your credit score, if not optimal, can cost you 10’s if not 100’s of thousands of dollars. Understanding your credit score can help you make some decisions about how you utilize credit.

What is a Credit Score

Credit scores are an expression of your creditworthiness based on a number created by a mathematical algorithm. Credit scores are used by banks, credit cards, stores, etc… to assess risk in loaning you money. Specifically, what is the likeliness

of the consumer having a serious default in the next 24 months.

The most common system used for mortgages is the FICO system, which stands for Fair Isaac Corporation. The Fair Isaac Corporation developed the system in the 1950s and is still the most widespread system used. When you are applying for a home mortgage we are talking about a credit score we are actually talking about your FICO score.

A typical mortgage credit report will be a FICO score from all three credit reporting agencies. The Three Credit agencies are Experian, Equifax and TransUnion. The credit scores will typically range from 300-850 with a 600-620 credit score being the minimum allowed for most types of credit.

What Is A Good Credit Score Range?

Your FICO Score is:

- Exceptional if it is 800+ and is made up of 20% of the population- Credit should be very easy to obtain with the very best rates.

- Very Good if it is 740-799 and is made up of 18% of the population- Credit should be easy to obtain with very competitive rates.

- Good if it is 670-739 and is made of of 22% of the population- Credit will be accessible to you with fairly competitive rates.

- Fair if it is 580-669 and is made up of 20% of the population- Credit will be tighter to obtain and you will start to pay a premium in rates.

- Poor if it is 300-579 and is made up of 17% of the population- Credit will probably be not existent to you and if it is available you will pay a heavy premium.

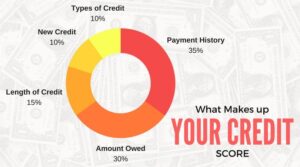

Understanding What Makes Up Your Credit Score

Your credit is a complicated algorithm. Complicated enough to make it hard to manipulate. But there are 5 areas that go into making up your credit score and they are weighted depending on importance.

- Payment History- Pay your bills on time and you won’t have any problems. One or two missed payments might be alright but once you get into rolling late payments and collections it will take a long time to correct.

- Amount Owed- The amount owed versus your available credit. A good rule of thumb is try not to use anymore than 30% of your available credit for one line. Yes, your credit takes a ding especially when you hit the 50% of your available credit is used.

- Length of Credit History- The older the credit the better. Your last activity and the date you opened the credit is looked at. You should never close out your oldest lines with out carefully considering the impact. A credit card you have had for 20 years with perfect payment will go a long way.

- Type of Credit- They look at the mix of installment vs lines and unsecured vs secured debt. There are certain lines of credit that are better than others. If you have lots of lines of installment credit that is not looked upon favorably.

- New Credit- You should be very careful opening new lines of credit. If you do pace yourself and don’t do it all at once.

7 Common Mistakes People Make With Their Credit Score

Here are some simple things people do every day to destroy their credit. If your credit profile is good don’t do anything to change it without serious consideration.

- Close Out Old Accounts- As stated above the older the account the better. Closing out old accounts is usually never a good idea especially if it leaves you with just a bunch of newer accounts. You are probably better off paying the line off and leaving it open.

- Being a Co-Signer- Most people don’t really think about it but when you are a co-signer that line of credit shows up on your credit. On top of it you have no control how the party you signed for takes care of that line of credit.

- Don’t Use Credit- You may have plenty of credit but if you don’t use it there is nothing to report. The agencies like to see use on the lines of credit. Even if you use it and pay it off immediately that is showing use.

- Max Out Your Credit– Even if you are making timely payments maxing out your available lines of credit is never a good idea. For every 25% or so you use of a line of credit you take a serious ding. It is best to keep your balances under 25% of your limit.

- Opening New Cards for the 0% interest rate on balance transfers- This is not a good idea if you are trying to maintain your credit. Constantly open new credit and closing old lines or having too much available credit will hurt your credit score.

- Opening Department Store Credit Cards Just to Get A Discount- Sure its great to save 10 or 20% on a purchase but again you are opening a new line of credit. If you are the type of person likes the discount you probably have a slew of department store cards in your pocket.

- Never checking your credit– Mistakes and fraud happen, more often than you think. Get into the habit of checking your credit score at least once a year to make sure there are no problems. If there is at least you have time to take care of a problem before you have to rather than in the middle of trying to get a mortgage.

Checking Your Credit

You can annually pull your credit report for free, once a year from each of the credit bureaus. Go to www.myannualcreditreport.com to get your free, annual credit report. This will not give you a credit or FICO score but will list what is being reported to the agencies.

Look for errors, it is not uncommon at all to have errors on your credit report. Many credit report errors can be quickly corrected. If you have some derogatory credit, research how you may go about rectifying it in the best way possible. By law most derogatory credit is removed after 7 years.

To actually get your FICO score you will probably have to pay for it from www.myfico.com. Realize there are different ways of reporting and when you go to get a mortgage your credit score may be different than what you have pulled in the past..

Final Thought on Understanding Your Credit Score

Your credit score has far reaching impact for you. Understanding your credit score can go a long way in maintaining your credit. Sometimes simple things can have a disastrous effects on your credit.

Whether you are in the market to buy a house, or will be buying a house sometime in the near future, now is the time to pay attention to your credit and then maintain it. Not only will it effect your ability to get a home mortgage it will effect your ability to get automobile loans, credit cards, etc…. Furthermore, credit scores will effect the interest rates you receive as well as insurance rates and possibly in being hired for a job.

No matter where you are at in life, learn about your credit score and keep making those payments on time. You might not need credit now but you never know when you may need it in the future.

___________________________________________________________________________________

The Ultimate Guide to Understanding your Credit Score was written by Kevin Vitali of EXIT Group One Real Estate. Thinking of buying a home and want to make the most of your purchase? Call me at 978-360-0422.

Real Estate Services in the following areas: Northeast Massachusetts, Merrimack Valley, North Shore and Metrowest. Including the following communities and the surrounding area- Amesbury, Andover, Billerica, Burlington, Chelmsford, Dracut, Groveland, Haverhill, Lowell, Melrose, Merrimac, Methuen, Middleton, North Andover, North Reading, Reading, Stoneham Tewksbury, Tyngsborough, Wakefield, Wilmington, Westford