Understanding the Concept of Adding Children to the Deed

Legally, adding children to a deed transfers partial ownership of the property to them immediately. Unlike naming them as beneficiaries in your will, this move grants them legal rights over the property while you’re still living.

Legally, adding children to a deed transfers partial ownership of the property to them immediately. Unlike naming them as beneficiaries in your will, this move grants them legal rights over the property while you’re still living.

It’s co-ownership, meaning they share responsibilities for the property, such as paying taxes, maintaining the property, and managing legal obligations. While this might seem like an excellent strategy to avoid probate and ensure a smoother inheritance process, it comes with legal and financial complexities that could overshadow the benefits.

Parents often add their children to the deed to avoid probating the house, thinking it will simplify the property transfer after they pass away. But probate avoidance isn’t the only factor to consider.

Laws Regarding Ownership Are Complicated and Vary Drastically From State to State

The laws surrounding property ownership and probate vary significantly from state to state, and what might seem like a good solution in one state could lead to unintended consequences in another. Always check with financial and legal counsel before making a change.

Additionally, there are various forms of ownership, such as joint tenancy and tenancy in common, which carry different legal implications. Each arrangement impacts how taxes are applied, how the property is transferred, and what happens if one of the owners passes away before the others.

Understanding the differences between these forms of ownership and their impact on your estate plan is crucial. Without this knowledge, you might make decisions that create unintended stress, both financially and relationally, down the road.

Potential Benefits of Adding Children to the Deed to Your Home

Adding children to the deed can offer several advantages. One of the most appealing is avoiding your heirs having to probate the house.

With co-ownership, depending on the property, you can pass directly to the children upon your death, saving time and costs associated with the probate court. This can reduce some of the emotional and financial burdens your family might face after you pass away.

Additionally, involving your children in the ownership of the property can help prepare them for the future responsibilities that come with it. They can become familiar with managing the property’s upkeep, taxes, and other legal obligations while you’re still there to provide guidance. This process can foster a sense of ownership and continuity within the family.

Potential tax benefits may also exist, but they are highly specific to the individual situation. For example, some states offer tax exclusions or deductions for co-owners who live on the property as their primary residence.

However, the tax landscape is complicated, so getting professional advice tailored to your situation is critical your heirs having to probate

Potential Drawbacks of Adding Children to the Deed

Despite the potential benefits, there are several significant drawbacks to adding children to the deed. Perhaps the most concerning is the loss of control over the property. As co-owners, your children have equal rights to make decisions regarding the property. This could lead to disputes if their intentions or financial situations change over time, creating stress and tension within the family.

Another significant issue is the risk that your children’s financial or legal problems could become yours. If one of your children is sued, files for bankruptcy, or faces a financial crisis, their ownership stake in the property could become vulnerable. Creditors might place liens on the property, or the home could be forced into a sale, potentially leaving you without your home.

Important! Once some one is added to the deed, they cannot be removed unless they agree.

Tax Consequences May Be A Critical Factor To Consider

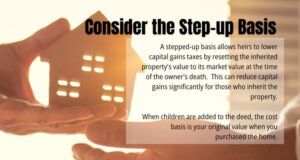

Adding children to the deed may result in capital gains taxes when the property is sold, and the children may not receive the stepped-up basis that typically comes with inherited property.

When a house is inherited, a step-up in basis can adjust the property’s cost basis for tax purposes. The new cost basis is set to the home’s market value on the previous owner’s date of death. This adjustment can significantly reduce capital gains taxes when the property is sold in the future, as the heirs only pay taxes on the increase in value from the new cost basis, not the original purchase price.

This could lead to much higher taxes than anticipated, especially if the property has appreciated significantly over the years.

Depending on the circumstances, this could also put your children in the position of having to sell the home to cover the taxes and expenses.

Are you thinking about adding your children to your property’s deed? It might seem like a convenient way to streamline the inheritance process, but there are some important reasons why this move could have more downsides than benefits.

While ensuring your home passes directly to your children may sound straightforward, adding them to the deed to your home can introduce complications that may not align with your overall estate planning goals.

Let’s dive into why you may want to rethink this decision and consider alternative options that better suit your needs.

Why May It Be A Bad Idea?

One of the most significant concerns about adding your children to the deed is the potential loss of control over your property. Once their names are on the deed, they become co-owners, meaning they have legal rights and decision-making power over the property.

This could lead to disagreements, especially if their ideas for the property don’t match your own intentions. Additionally, co-ownership introduces potential financial risks, particularly if your children experience financial troubles or become entangled in legal issues. Their ownership stake could become vulnerable to creditors, or worse, put your property at risk if they declare bankruptcy.

It’s also essential to consider the tax implications. Adding your children to the deed can result in significant capital gains taxes when the property is sold, which might be higher than expected due to the lack of a stepped-up basis at the time of inheritance. There are also estate tax consequences that vary by state, which could further complicate your financial picture.

It’s vital to consult with legal and financial professionals to explore all the options and understand how these decisions could affect your overall estate plan

Adding Children To Your Deed Can Have Legal Implications and Considerations

Before you add your children to the deed, it’s essential to understand the legal implications fully. Property ownership and inheritance laws vary widely by state, and what works in one situation may not apply in another.

For instance, adding children to the deed could trigger gift tax liabilities, depending on the property’s value and the applicable state laws. This could introduce financial obligations you hadn’t anticipated. Though federally, the exemption is quite high and would have to be a mega-mansion for the gift tax to kick in. But some states have an exemption as little as a million dollars.

Additionally, different forms of ownership—such as joint or tenancy in common—have distinct legal consequences. For example, joint tenancy includes the right of survivorship, meaning if one owner passes away, the other automatically inherits the deceased’s share. In contrast, tenancy in common allows each owner to independently manage their share, which can lead to complications if one owner wishes to sell their portion.

If the property is held as tenants in common, your portion of the home will most likely have to be probated.

Interview On Estate Planning

Kevin Vitali- Haverhill MA Realtor, Dan Hinchey- Probate and Estate Attorney

See the segment on why adding children to your deed may not be the best idea. If you are thinking about planning your estate, this interview is packed with must-know info!

Alternative Options for Passing on Property to Children

If adding children to the deed seems too risky, other options exist. One popular alternative is an irrevocable living trust. This allows you to maintain complete control over your property during your lifetime while specifying that it will pass to your children upon your death without going through probate. A living trust can be flexible and straightforward to ensure your wishes are followed.

Another option is a transfer-on-death (TOD) deed available in some states. Unfortunately, this is not an option in Massachusetts.

This allows you to designate beneficiaries who will automatically receive the property when you die. Like a living trust, this option bypasses probate but keeps full control of the property in your hands while you’re alive.

Lastly, some families gift property to their children but retain a life estate, meaning you keep the right to live in and use the property for the rest of your life. After your death, ownership transfers to your children, avoiding some of the complications that come with co-ownership while you’re still alive.

FAQs

What does it mean to add my child to the deed of my property?

Do I lose control of my home if I add my child to the deed?

Will adding my child to the deed protect the property from probate?

Are there any tax consequences for adding my child to the deed?

Can I remove my child from the deed later if I change my mind?

Should I consult a lawyer before adding my child to the deed?

Final Thoughts

Deciding whether to add your children to the deed is a significant decision that requires careful consideration. While simplifying the inheritance process may be appealing, the potential drawbacks must be considered, including loss of control, financial risks, and tax implications. Consulting with legal and financial professionals is a must. It can help you understand the full scope of your options and develop a plan that meets your family’s unique needs.

Ultimately, the goal is to ensure a smooth property transition while protecting your assets and preserving family harmony. Alternatives like living trusts or TOD deeds can offer safer, more flexible routes to achieving your estate planning goals.

Also, remember that not every option is suitable for everyone. Working with financial and legal professionals can help you find the option that best suits you and your intentions.

Author Bio

Kevin Vitali is a Massachusetts REALTOR out of Haverhill MA that serves Essex County and Northern Middlesex County in Massachusetts. If you want to buy or sell a home, let me use my years of experience to get you the best possible outcome.

Feel free to contact me to discuss any upcoming moves. I am always happy to answer your questions

Call 978-360-0422 Email kevin@kevinvitali.com