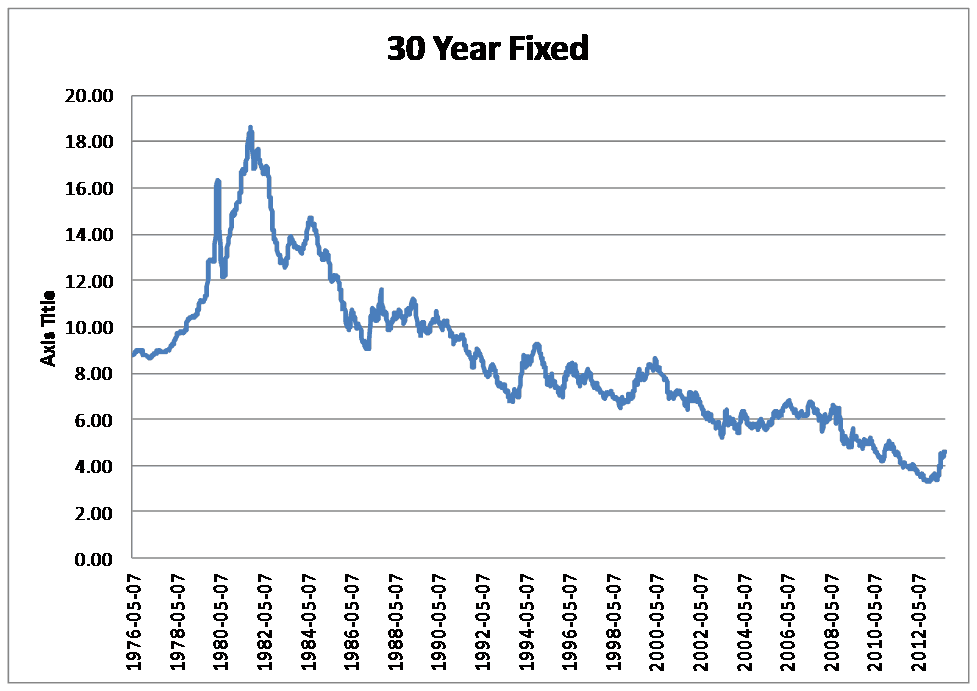

The 30 Year Interest Rate a historical look

The 30 year interest rate is what everyone asks about and what most people use to finance a home. I just ran across some data at the Fannie Mae website, showing interest rates going back to 1971. We have and still are seeing historically low interest rates on the 30 year fixed mortgage. While we have seen a spike in the rate recently it is still very low. From 1972 to 2012 the average annual interest rate was 8.70%

Data shows a low of about 3.35% in December of 2012 and a high of 18.45% in October of 1981. Rates of today are about 4.5%.

The recent surge in the 30 year fixed mortgage rate has softened the market a tad through the summer but as a home buyer you should be looking at where they have been historically. If history repeats itself we are still at an all time low and rates will probably only climb from here.

The previous low was in the early to mid 60’s where the 30 year fixed was hovering around 6%.

Even with the recent rise binging us to the 4.5% to 5% range it is still some of the lowest interest rates we have seen in 50 years. The good thing about the slight rise in interest rates is that it did cool down a rapidly rising housing market. This spring we were seeing surging house prices and multiple offers with many homes going over asking. The rise has slowed down that frenetic pace, while keeping it in a good balance.

Historical Data of the 30 Year Fixed Rate Mortgage

If you are a potential home buyer and are thinking of taking advantage of the stabilizing housing market and low interest rates, give me a call. I can introduce you to a few lenders who can go over the numbers with you. You may find that owning a home can cost you less per month then renting! I can be reached at 978-360-0422 or email me at kevin@kevinvitali.com.