What is Title Insurance? And Why Do I Need It?

Learn what title insurance is and if you need it. If your financing a home you will be required to have a lender's policy, bit a homeowners policy is optional.

Learn what title insurance is and if you need it. If your financing a home you will be required to have a lender's policy, bit a homeowners policy is optional.

There is a lot to know when buying a home. And, if you are buying your first home they are easy to make. Learn about the most common mistakes and how to avoid them.

Selling the real estate property isn’t as easy as it may look like. In order to attract potential buyers and influence their decision, you’ll need to do your best while staging the house. Before you make any investments toward staging…

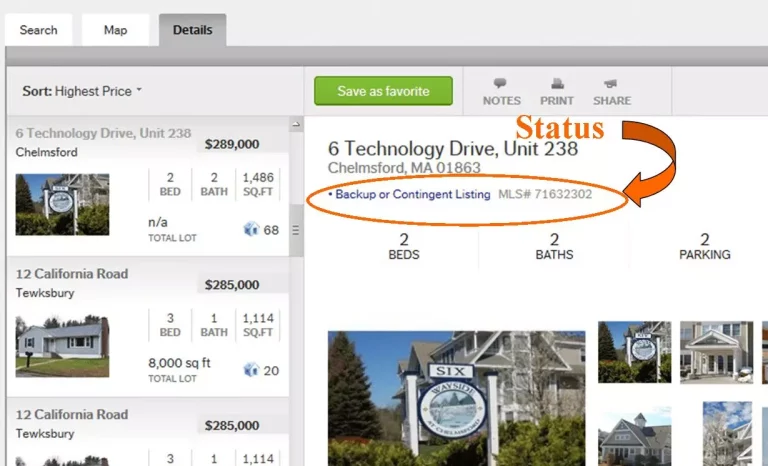

Over the years I have found much confusion about the availability of homes for sale when doing a Massachusetts Home Search. When you are thinking of buying a home many buyers will just start cruising the internet looking for a…

Accompanied Showings…. a definite NAY! Occasionally, I am asked to do accompanied showings on a potential listing. For 99.9% of the homes I market for sale to the public, this is a huge mistake. The only time I recommend accompanied…

One thought thrown around by home sellers is… I will wait until my home was worth 5 years ago before I purchase a new one. Seems to makes sense…. or does it? On the surface it probably seems to make…

How to negotiate an offer on a home is very individual to a home buyer. There are many variables to negotiating an offer on a home. Some of the variables are specific to the home buyer, some are specific to…